Chainlink LINK Price

- Oracle

- Optimism Ecosystem

- Ethereum Ecosystem

- Cardano Ecosystem

- Gnosis Chain Ecosystem

- Arbitrum Ecosystem

- Near Protocol Ecosystem

- Solana Ecosystem

- Polygon Ecosystem

- Harmony Ecosystem

- Smart Contract Platform

- BNB Chain Ecosystem

- Polkadot Ecosystem

- Fantom Ecosystem

- Avalanche Ecosystem

- Mantle Ecosystem

- Linea Ecosystem

- DePIN

- Friend.tech Ecosystem

- Manta Network Ecosystem

- Osmosis Ecosystem

- Liquid Restaking Governance Tokens

- Osmosis Ecosystem

- Cosmos Ecosystem

- Gaming Utility Token

- Sports Games

- Simulation Games

- TON Meme

- Anime-Themed

- Bitlayer Ecosystem

- BEVM Ecosystem

- XRP Ledger Ecocystem

- Sora Ecosystem

- Polygon zkEVM Ecosystem

- Huobi ECO Chain Ecosystem

- Terra Classic Ecosystem

- Milkomeda (Cardano) Ecosystem

- Venture Capital Portfolios

- Secret Ecosystem

- Viction Ecocystem

- OKT Chain Ecosystem

- Oasis Emerald Ecosystem

- Bahamut Ecosystem

- Kucoin Community Chain Ecosystem

- opBNB Ecocystem

- LightLink Ecosystem

- Wanchain Ecosystem

- Conflux Ecosystem

- Waves Ecosystem

- Flare Network Ecosystem

- SmartBCH Ecosystem

- Boba Network Ecosystem

- EOS Ecosystem

- Rootstock Ecosystem

- Massa Ecosystem

- Oasys Ecosystem

- ThunderCore Ecosystem

- X Layer Ecosystem

- DFK Chain Ecosystem

- Songbird Ecosystem

- Hydra Ecosystem

- ShimmerEVM Ecosystem

- Migaloo Ecosystem

- Fraxtal Ecosystem

- NEO Ecosystem

- Elastos Smart Contract Chain Ecosystem

- BitTorrent Ecosystem

- Syscoin NEVM Ecosystem

- Astar zkEVM Ecosystem

- VeChain Ecosystem

- Bitrock Ecosystem

- Oasis Sapphire Ecosystem

- Meter Ecosystem

- Ethereum Classic Ecosystem

- Proof of Memes Ecosystem

- Ancient8 Ecosystem

- BounceBit Ecosystem

- Omnia Ecosystem

- Re.al Ecosystem

- Zedxion Ecosystem

- UTON Ecosystem

- Nahmii Ecosystem

- Boba BNB Ecosystem

- Fantom Sonic Ecosystem

- Vyvo Smart Chain Ecosystem

- GMCI 30 Index

- X1 Ecosystem

- Edgeware Ecosystem

- Ethereum PoW IOU

- Celer Network

- GMCI DeFi Index

- Unicly Ecosystem

- KRW Stablecoin

- Infrastructure

- Pixels Game

- Animoca Brands Portfolio

- Parallel Ecosystem

- Puma Ecosystem

- Adidas Ecosystem

- PFP / Avatar

- Jack Butcher Ecosystem

- Nike Ecosystem

- Pudgy Ecosystem

- Berachain Ecosystem

- Mid-Cap PFP

- DeLabs

- Art Blocks Ecosystem

- Memeland Ecosystem

- Business Services

- NounsDAO

- Web 2 Brands

- F1 Partnership

- Large-Cap PFP

- Bored Ape Ecosystem

- Proof Ecosystem

- CyberKongz Ecosystem

- Ethereum PoS IOU

- Wolverine-Themed

- US Election 2020

- Niftex Shards

- Azuki Ecosystem

- GBP Stablecoin

- Remittance

- Doodles LLC

- OCM Ecosystem

- Haqq Network Ecosystem

- Investment

- AlienX Ecosystem

- Saakuru Ecosystem

- Cyber Ecosystem

- Energi Ecosystem

- Mainnetz Ecosystem

- Etherlink Ecosystem

- Dex Aggregator

- Commodity-backed Stablecoin

- Algorithmic Stablecoin

- RWA Protocol

- Tokenized Real Estate

- Crypto-backed Stablecoin

- Index Coop DeFi Index

- Centralized Exchange (CEX) Token

- ASC-20

- Index Coop Index

- Centralized Finance (CeFi)

- Centralized Exchange (CEX) Product

- GMCI Index

- Index Coop Metaverse Index

- Fiat-backed Stablecoin

- Milady And Derivatives

- Synthetic

- HyperXpad Launchpad

- NFT Collections That Received Airdrops

- XT Smart Chain Ecosystem

- AI Applications

- Rari Ecosystem

- Cronos zkEVM Ecosystem

- Liquid Restaked SOL

- Liquid Restaked ETH

- Q Mainnet Ecosystem

- Gravity Alpha Ecosystem

- Sei v2 Ecosystem

- ENULS Ecosystem

- Moonchain Ecosystem

- Mint Ecosystem

- Jibchain Ecosystem

- Qitmeer Network Ecosystem

- Ham Ecosystem

- MaxxChain Ecosystem

- GraphLinq Ecosystem

- inEVM Ecosystem

- Alveychain Ecosystem

- Lung Ecosystem

- MultiVAC Ecosystem

- DefiMetaChain Ecosystem

- Larissa Ecosystem

- Combo Ecosystem

- PlatON Network Ecosystem

- Elysium Ecosystem

- Redstone Ecosystem

- Onchain Ecosystem

- Terraport Launchpad

- Flow EVM Ecosystem

- Zircuit Ecosystem

- Floor Protocol Tokens

- Index

- OEC Ecosystem

- HECO Chain Ecosystem

- Tenet Ecosystem

- Apex Chain Ecosystem

- Zano Ecosystem

- Real World Assets (RWA)

- Base Ecosystem

- Cross-chain Communication

- Liquid Staking

- Blast Ecosystem

- Celo Ecosystem

- Core Ecosystem

- Astar Ecosystem

- Cronos Ecosystem

- Hedera Ecosystem

- Metis Ecosystem

- Moonriver Ecosystem

- Mode Ecosystem

- Merlin Chain Ecosystem

- Ronin Ecosystem

- Scroll Ecosystem

- Starknet Ecosystem

- Shibarium Ecosystem

- WEMIX Ecosystem

- Zora Ecosystem

- Internet of Things (IOT)

- Entertainment

- Education

- Energy

- Healthcare

- Marketing

- Klaytn Ecosystem

- Privacy

- Optimism Superchain Ecosystem

- Cybersecurity

- XDC Ecosystem

- Artificial Intelligence (AI)

- LINK/USD

- LINK/USDC

- LINK/WETH

- LINK/KRW

- LINK/EUR

- LINK/BTC

- LINK/ETH

- LINK/TRY

- LINK/FDUSD

- LINK/USD1

- LINK/JPY

- LINK/WETH

- LINK/INR

- LINK/XRP

- LINK/GBP

- LINK/WPOL

- LINK/BRL

- LINK/WETH

- LINK/TWD

- LINK/WETH

- LINK/PHP

- LINK/RUNE

- LINK/XT

- LINK/PLN

- LINK/WBNB

- LINK/USDT0

- LINK/IDR

- LINK/BNT

- LINK/H2O

- LINK/WETH

- LINK/AUD

- LINK/BSC-USD

- LINK/WBTC

- LINK/BNB

- LINK/BTCB

- LINK/AAVE

- LINK/ZAR

- LINK/BLACK

- LINK/WAVAX

- LINK/USDC.E

- LINK/UNI

- LINK/AERO

- LINK/THB

- LINK/WETH

- LINK/DAI

- LINK/SGD

- LINK/NZD

- LINK/USDC

- LINK/MYR

Chainlink Price chart

Statistics

| Chainlink Price $13.11 | All-time high $52.7 | Days since ATH 1708 |

| Price change -$0.136 (-1.0335%) | Date of ATH May 10, 2021 | % of ATH -75.13% |

Related cryptocurrencies

Chainlink Review

Founded Date: Jan 1, 2014

Founders:

Co-founder & CEO

Co-founder & CTO

Chainlink(LINK) - Coin Trading Data

| Chainlink Price | $13.11 |

| Ticker | LINK |

| Market Capitalization | $9.28B |

| Fully Diluted Valuation (FDV) | $13.1B |

| Value 24h low | $12.99 |

| Value 24h high | $13.49 |

| Trade Volume for 24h | $409.39M |

| Current Circulating Supply | 708.1M |

| Maximum Supply | 1B |

| Algorithm | |

| ICO Price and ICO ROI | 0.11 USD 119.18x |

| Price Change 24h % | -1.0335% |

| LINK quote | $13.11 |

| Fully Diluted Valuation (FDV) | $13.1B |

Chainlink(LINK) ATH - All Time High Price

| Chainlink ATH Price | $52.7 |

| Days Since LINK ATH | 1708 |

| ATH Date | May 10, 2021 |

| All Time High % | -75.13% |

Chainlink Profile

Chainlink is the industry-standard oracle platform bringing the capital markets onchain and powering the majority of decentralized finance (DeFi). Chainlink stands to benefit the most from emerging blockchain-industry trends, such as stablecoin adoption, real-world asset tokenization, and institutional adoption of blockchain technology. Chainlink is powered by the LINK token, which is used to pay for platform services and secure the network’s proper functioning. Chainlink leverages a novel fee model where offchain and onchain revenue from enterprise adoption is converted to LINK tokens and stored in a strategic Chainlink Reserve.

Chainlink is at the forefront of financial innovation and the global tokenization trend. Traditional financial institutions and infrastructures, such as Swift, DTCC, Euroclear, J.P. Morgan, Mastercard, Central Bank of Brazil, UBS, SBI, Fidelity International, ANZ, and many others are adopting Chainlink as fundamental infrastructure as they move toward tokenizing trillions onchain. Demand for Chainlink has already generated hundreds of millions of dollars in revenue across a variety of traditional and decentralized use cases.

How Chainlink Operates

Chainlink is a set of open standards for onchain data, cross-chain interoperability, and offchain computation. The platform is powered by decentralized oracle networks (DONs), which are composed of independent oracle node operators that come to consensus over any arbitrary input to deliver highly secure and reliable data, computation, and value to its intended destination. Chainlink node operators include traditional Web2 telecommunication providers, leading data providers, and Web3 infrastructure providers such as Deutsche Telekom, Swisscom, Vodafone, and Infura.

Users receive data from selected oracles. For example, if a user's smart contract needs to receive data from the New York Stock Exchange, it needs to use only that data that comes from oracles connected to the New York Stock Exchange.

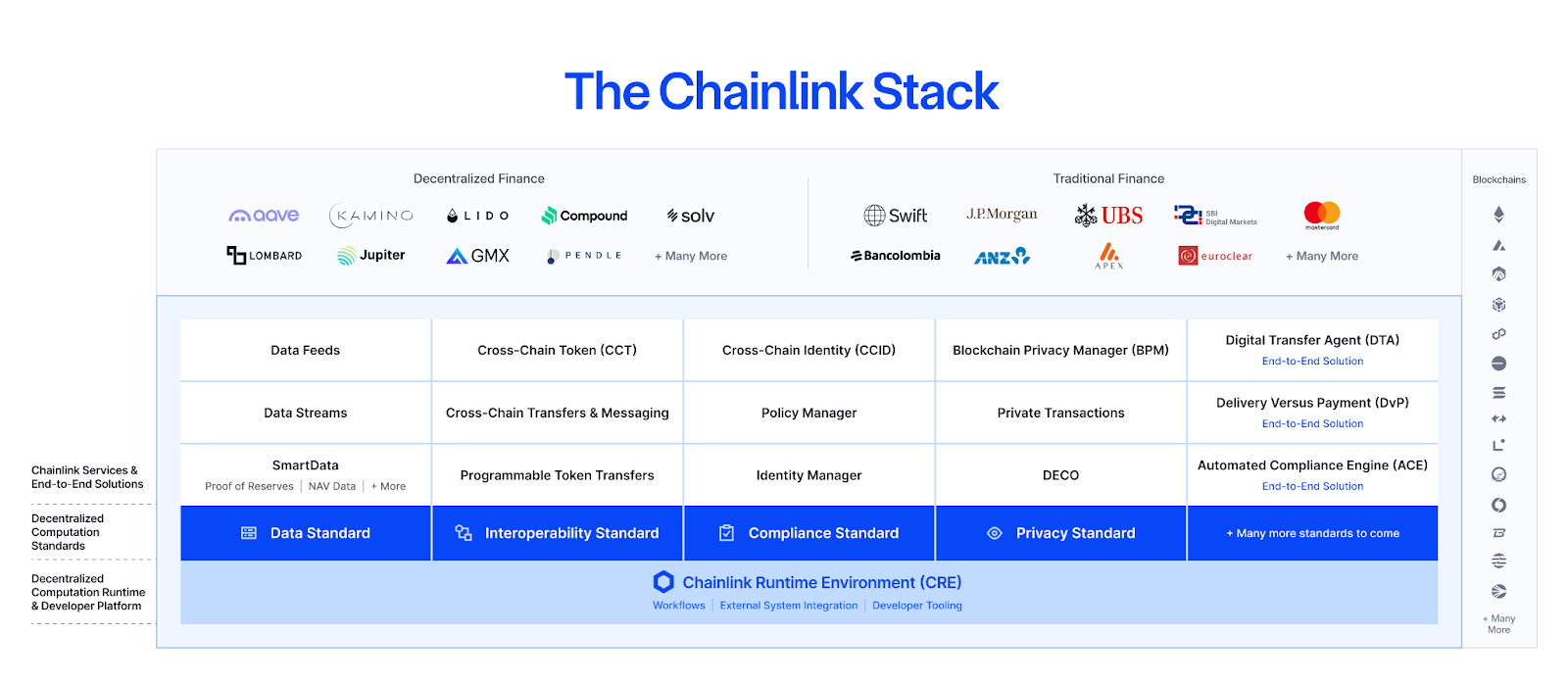

Chainlink Stack

History of ChainLink

- 2017, White paper release & ICO: The Chainlink white paper - co‑authored by Sergey Nazarov, Steve Ellis, and Cornell’s Ari Juels—was published, laying the foundation for the protocol. Also in 2017, Chainlink held its ICO (raising about $32 million).

- 2018, Integration of Town Crier: Chainlink integrated Town Crier - a trusted execution environment–based oracle system developed by Ari Juels - allowing Ethereum smart contracts to fetch HTTPS web data securely.

- 2019, Mainnet launch: Chainlink officially launched on Ethereum mainnet on May 30, 2019.

- 2020, Integration of DECO: Team acquired and integrated DECO - a zero‑knowledge‑proof protocol developed at Cornell—enabling verifiable data feeds without exposing private data.

- 2021, Chainlink 2.0 white paper: Released in April 2021, this outlined the vision for hybrid smart contracts - combining on‑chain code with off‑chain oracle services.

- 2022, Economics 2.0 & Staking roadmap: At SmartCon 2022 and Consensus, Chainlink announced its Economics 2.0 model, including staking (to secure the network) and the Build program for projects contributing tokens in exchange for premium services.

- 2023, CCIP mainnet and expansion: The Cross‑Chain Interoperability Protocol (CCIP) launched on mainnet, with early adopters including Synthetix and Aave. Swift and Chainlink: Successfully demonstrate way to transfer tokenized assets cross-chain using CCIP.

- 2024, General availability of CCIP: Chainlink announced CCIP was available for broader usage.

- 2025, Reaching the White House: CEO Sergey Nazarov met the U.S. President at the White House Digital Asset Summit, highlighting Chainlink’s rising role in policy and adoption. Launch of the Chainlink Reserve: The Chainlink Reserve is designed to support the long-term growth and sustainability of the Chainlink Network by accumulating LINK tokens using offchain revenue from large enterprises that are adopting the Chainlink standard and from onchain service usage.

LINK

LINK is the native token of the Chainlink Network, used to pay for services, enhance network security, and earn rewards. Chainlink leverages a novel fee model where offchain and onchain revenue from enterprise adoption is converted to LINK tokens and stored in a strategic Chainlink Reserve. The Reserve is designed to support the long-term growth and sustainability of the Chainlink Network by accumulating LINK tokens using offchain revenue from large enterprises that are adopting the Chainlink standard and from onchain service usage, which has already generated hundreds of millions in revenue.

LINK Mining

LINK is an ERC-677 token. LINK cannot be mined.

Link and Chanelink Usage

The Chainlink platform fulfills the requirements of any institutional blockchain use case. The Chainlink platform enables developers and institutions to access all the critical data, interoperability, compute, compliance, privacy, and legacy-system connectivity required for advanced blockchain applications that link the onchain and offchain worlds. Chainlink solves four fundamental problems for institutions interacting with tokenized assets:

- The data problem. Tokenized assets need real-world information to be usable in transactions, such as market pricing, reference data, and proof of reserves data. Chainlink is the market leader in bringing real-world data onchain securely and accurately.

- The liquidity problem. Financial institutions need tokenized assets that can be securely accessed and moved across blockchain networks in order to maximize liquidity. Chainlink CCIP is the only cross-chain interoperability standard that securely connects any public or private blockchain - including Ethereum (ETH), Binance Smart Chain (BNB), Avalanche (AVAX), and Polygon (MATIC), opening up global markets for tokenized assets.

- The synchronization problem. Tokenized assets must remain synchronized with legacy systems once issued across multiple chains. Chainlink is the only platform that offers reliable offchain data, system connectivity, and secure cross-chain interoperability, enabling a Unified Golden Record that stays with assets anywhere.

- The compliance problem. Regulated institutions require compliance enforcement capabilities such as identity verification (KYC), risk screening (AML), exploit protection, and asset-specific restrictions. The Chainlink Automated Compliance Engine extends existing financial infrastructure for identity and compliance data to blockchains and tokenized assets.

Chainlink Pros and Cons

| Advantages | Disadvantages |

|---|---|

| Maintaining compatibility between Bitcoin, Ethereum, payment systems, and banking | Because this ecosystem is built and operated on Ethereum, the problems that are specific to ETH are also relevant to LINK |

| Administration and implementation of smart contracts at the highest level, as it involves the use of unique technologies as well as automation | A number of systems within the protocol can function using only one oracle, which can trigger the possibility of data manipulation |

| Decentralization of smart contracts, which additionally increases security and accuracy of information transfer | With the stated features, the ecosystem is a pioneer in the listed solutions, so the company itself dictates the terms and the following vector of development |

| Partnerships and collaboration with SWIFT, Oracle, Google Cloud |

Use case: Chainlink is the only all-in-one platform that fulfills the requirements of any institutional blockchain use case. The Chainlink platform enables developers and institutions to access all the critical data, interoperability, compute, compliance, privacy, and legacy-system connectivity required for advanced blockchain applications that link the onchain and offchain worlds. Chainlink solves four fundamental problems for institutions interacting with tokenized assets:

Partnerships: There are thousands of projects in the Chainlink Ecosystem. Chainlink is at the forefront of financial innovation and the global tokenization trend. Traditional financial institutions and infrastructures, such as Swift, DTCC, Euroclear, J.P. Morgan, Mastercard, Central Bank of Brazil, UBS, SBI, Fidelity International, ANZ, and many others are adopting Chainlink as fundamental infrastructure as they move toward tokenizing trillions onchain. Demand for Chainlink has already generated hundreds of millions of dollars in revenue across a variety of traditional and decentralized use cases.

Trust: The Chainlink Platform is leveraged by more than 2,400 projects and has enabled tens of trillions in onchain transaction value.

Summary

Chainlink is the industry-standard oracle platform bringing the capital markets onchain and powering the majority of decentralized finance (DeFi). The Chainlink stack provides the essential data, interoperability, compliance, and privacy standards needed to power advanced blockchain use cases for institutional tokenized assets, lending, payments, stablecoins, and more. Since inventing decentralized oracle networks, Chainlink has enabled tens of trillions in transaction value and now secures the vast majority of DeFi.

Q&A For Chainlink Cryptocurrency

How much is a one Chainlink worth now?

1 Chainlink worth $13.11 now.

What is the price of LINK?

The price of LINK is $13.11.

What is the Chainlink max supply?

The max supply of Chainlink is 1B.

What is the Chainlink stock symbol or ticker?

The stock symbol or ticker of Chainlink is LINK.

How many LINK coins are there in circulation?

There are 708.1M coins in circulation of LINK.

What is the exchange rate of Chainlink(LINK)?

The exchange rate of Chainlink is $13.11.

What was Chainlink's trading volume in 24 hours?

Chainlink's 24-hour trading volume is $409.39M.

What was the highest price paid for Chainlink?

Chainlink reached a record high of $52.7 on May 10, 2021

Chainlink Exchange Rates on Trading Markets

| # | Exchange | Pair | Price | 24h volume | Volume % | Updated | |

|---|---|---|---|---|---|---|---|

| 1 |

|

BVOX | LINK/USDT | $13.09 | $31.76M | 7.75% | 7 minutes ago |

| 2 |

|

Binance | LINK/USDT | $13.12 | $29.54M | 7.21% | 2 minutes ago |

| 3 |

|

HTX | LINK/USDT | $13.09 | $27.79M | 6.78% | 3 minutes ago |

| 4 |

|

MEXC | LINK/USDT | $13.1 | $21.79M | 5.32% | 4 minutes ago |

| 5 |

|

Coinbase Exchange | LINK/USD | $13.1 | $21.73M | 5.3% | a minute ago |

| 6 |

|

CoinW | LINK/USDT | $13.1 | $15.69M | 3.83% | 3 minutes ago |

| 7 |

|

Websea | LINK/USDT | $13.08 | $12.89M | 3.14% | 6 minutes ago |

| 8 |

|

Phemex | LINK/USDT | $13.1 | $12.63M | 3.08% | 46 seconds ago |

| 9 |

|

WhiteBIT | LINK/USDT | $13.18 | $12.62M | 3.08% | 8 minutes ago |

| 10 |

|

Binance | LINK/USDC | $13.11 | $10.85M | 2.65% | 2 minutes ago |

| 11 |

|

BloFin | LINK/USDT | $13.09 | $10.13M | 2.47% | 2 minutes ago |

| 12 |

|

Uniswap V3 (Ethereum) | LINK/WETH | $13.05 | $8.76M | 2.14% | a minute ago |

| 13 |

|

BitMart | LINK/USDT | $13.11 | $8.53M | 2.08% | 4 minutes ago |

| 14 |

|

LBank | LINK/USDT | $13.11 | $7.78M | 1.9% | 2 minutes ago |

| 15 |

|

Hotcoin | LINK/USDT | $13.1 | $6.57M | 1.6% | 2 minutes ago |

| 16 |

|

Ourbit | LINK/USDT | $13.09 | $6.34M | 1.55% | 4 minutes ago |

| 17 |

|

XT.COM | LINK/USDT | $13.07 | $5.99M | 1.46% | 6 minutes ago |

| 18 |

|

P2B | LINK/USDT | $13.07 | $5.95M | 1.45% | 5 minutes ago |

| 19 |

|

Tapbit | LINK/USDT | $13.08 | $5.84M | 1.43% | 7 minutes ago |

| 20 |

|

OKX | LINK/USDT | $13.09 | $5.63M | 1.37% | 2 minutes ago |