Next Bitcoin Halving Countdown For 2028

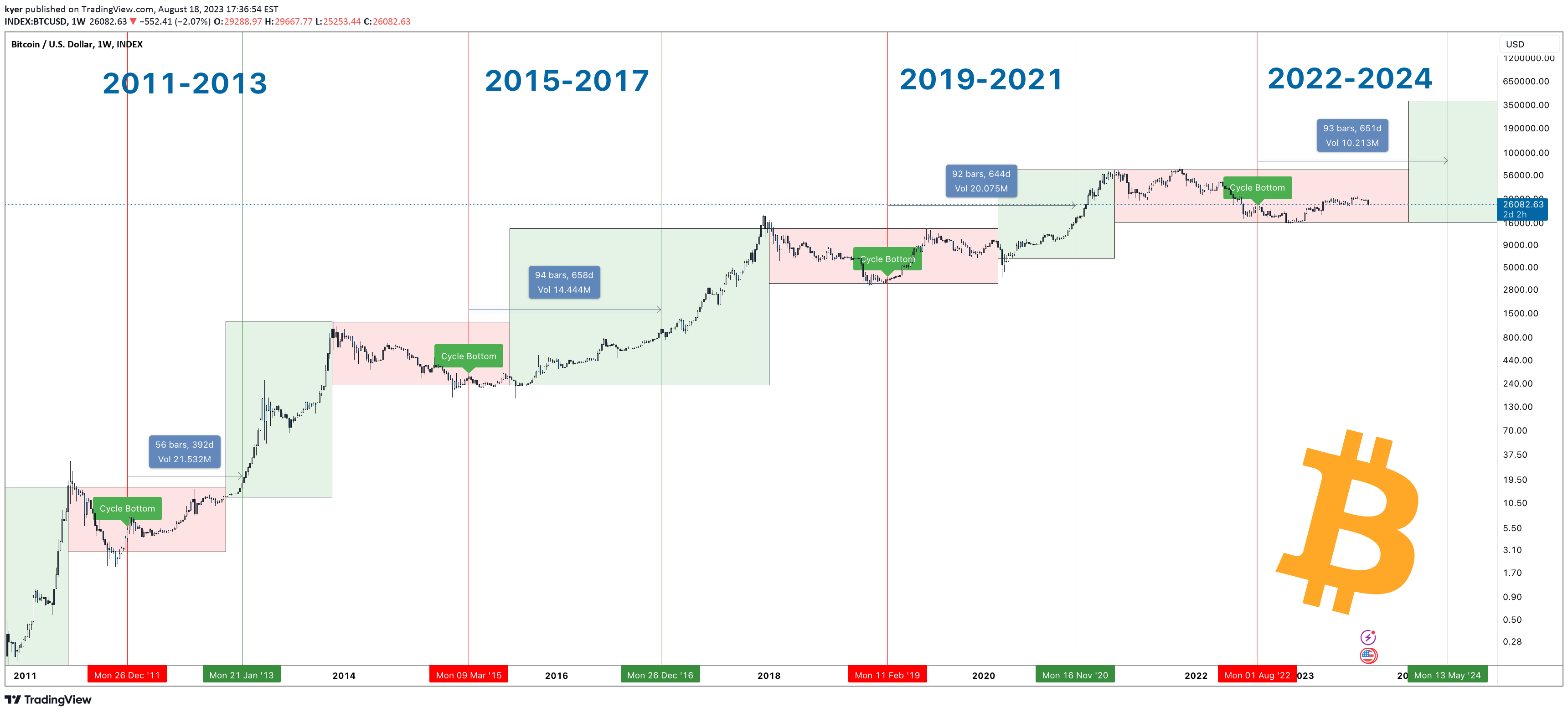

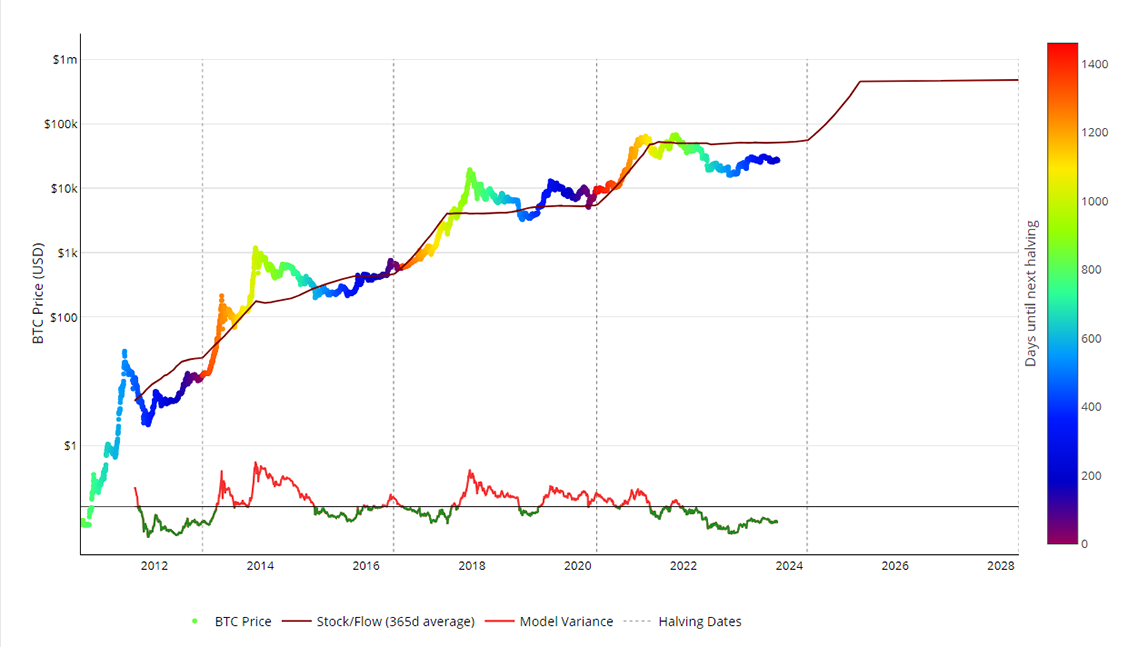

Bitcoin Halvings Chart 2011-2028

Bitcoin Price Prediction

Halving is getting closer. Here is the Bitcoin Price Prediction

Bitcoin Halving Dates History

| First halving event occurred on the 29th of November, 2012: | block height 210,000 |

| Second halving event occurred on the 10th of July, 2016: | block height 420,000 |

| Third Bitcoin Halving event occurred on the 11th of May, 2020: | block height 630,000 |

| Next Forth Bitcoin Halving event expected on block: | block height 840,000 |

Bitcoin Halving: Explained in Detail

Bitcoin halving is a significant event in the world of cryptocurrency, specifically in the Bitcoin network. It refers to the reduction in the rate at which new Bitcoins are created and awarded to miners. This process occurs approximately every four years and has a profound impact on the supply and potential value of Bitcoin. Let's break down the technical aspects and nuances of the Bitcoin halving process.

Background

Bitcoin operates on a decentralized and open-source protocol that uses a process called mining to validate transactions and add them to the blockchain.

Miners use powerful computers to solve complex mathematical problems; the first one to solve them gets the right to add the following block to the blockchain. As a reward for their efforts, miners are awarded newly minted Bitcoins and transaction fees.

Nonce: This is a 32-bit number that miners seek during the mining process. Miners iteratively change the nonce value to find the right one, which, when combined with the other block data, creates a hash that satisfies complex cryptographic conditions.

Hash: The hash is a cryptographic sum of the block's data, obtained using a hash function. In the case of Bitcoin, this is typically SHA-256 (Secure Hash Algorithm 256-bit). The block's hash must adhere to specific difficulty rules set by the protocol.

Data: This refers to the information contained in the block, including transactions and other metadata. A timestamp is also included in the block's data to indicate the time of its creation.

The mining process involves searching for the appropriate nonce value so that, when combined with the block's data, the resulting hash meets the specified cryptographic conditions (starting with the required number of leading zero bytes). This confirms the miner's proof-of-work and facilitates the addition of a new block to the blockchain.

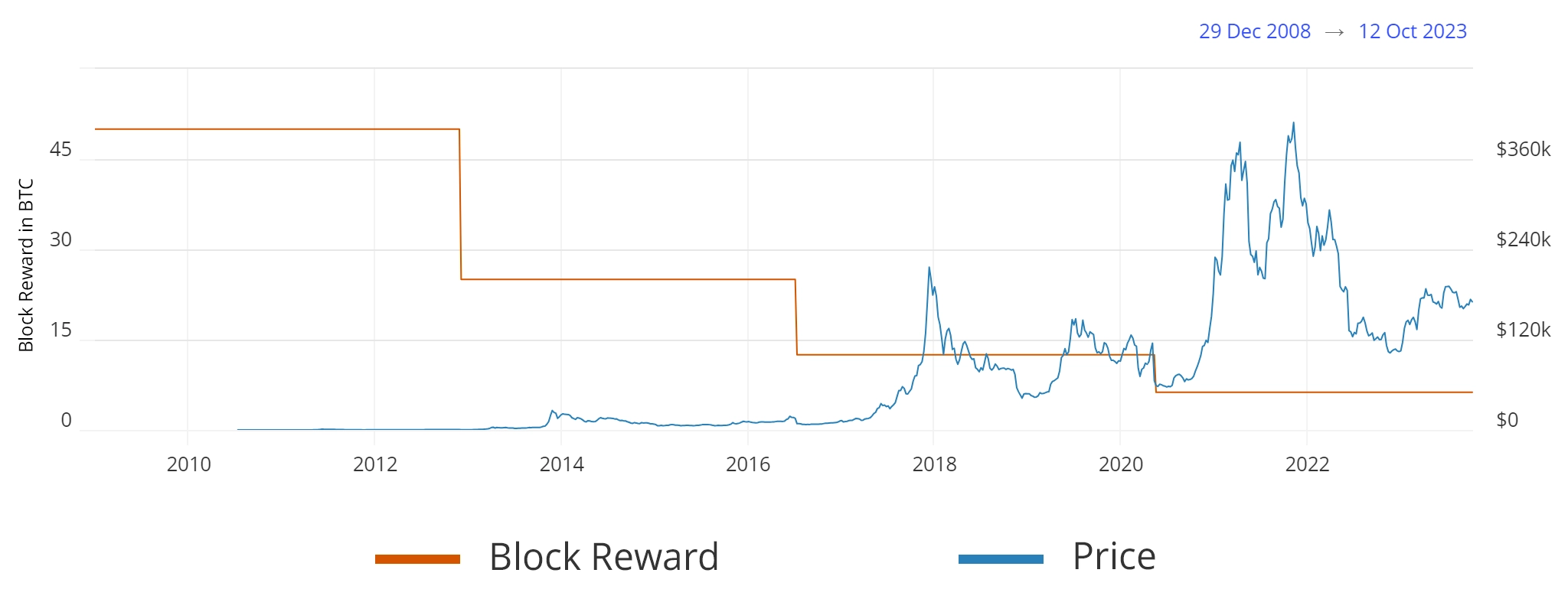

Mining Reward and Halving

When Bitcoin was launched in 2009, miners were rewarded with 50 Bitcoins for every block they mined.

The Bitcoin protocol is designed to cut this reward in half approximately every 210,000 blocks, which is roughly every four years. This event is referred to as the "halving."

Reward per block in BTC over time

The first halving occurred in 2012, reducing the mining reward to 25 Bitcoins per block. The second halving took place in 2016, reducing the reward to 12.5 Bitcoins per block.

Purpose of Halving

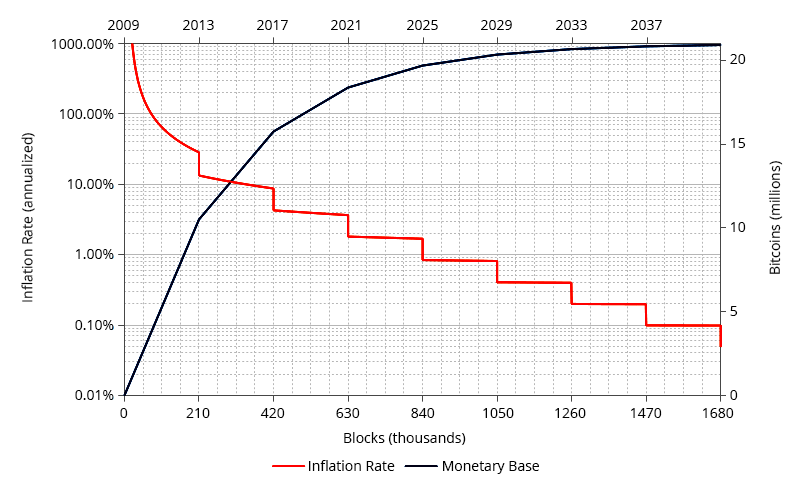

The primary purpose of halving is to control the issuance of new Bitcoins and ensure scarcity. By reducing the rate at which new Bitcoins are created, Bitcoin's total supply approaches its hard cap of 21 million coins over time.

Michael Saylor on Bitcoin Scarcity

Scarcity is a fundamental aspect of Bitcoin's value proposition, often compared to precious metals like gold.

Supply Dynamics

The total supply of Bitcoin is capped at 21 million coins. This scarcity is designed to prevent inflation and maintain the value of the cryptocurrency over time.

Bitcoin Inflation vs Time

Halvings play a crucial role in achieving this scarcity by gradually slowing down the rate of new Bitcoin issuance.

Mining Impact

Halving has a significant impact on miners, as their mining rewards are cut in half. Miners must compete to maintain profitability, as their expenses remain relatively constant even as the reward decreases.

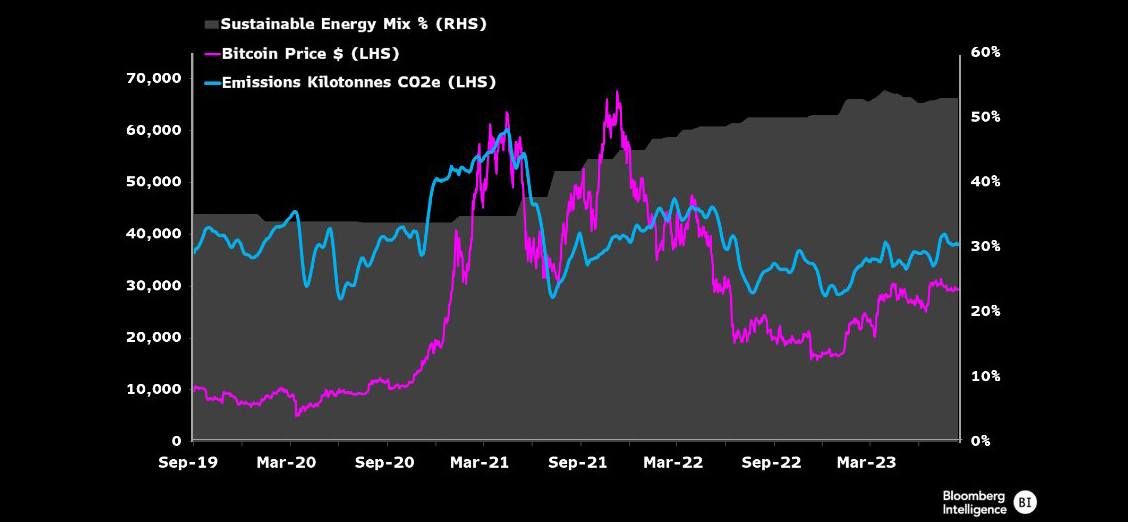

Percent of Mining From Renewable Sources

Some less efficient miners might be forced to shut down their operations after a halving, leading to a potential consolidation in the mining industry.

Price Speculation

Historically, Bitcoin halvings have been associated with periods of increased price speculation and volatility. The anticipation of reduced supply often leads to higher demand and, consequently, potential price appreciation.

Stock To Flow Model (S2F) is a model used in asset price analysis based on the ratio between the total existing stock of an asset (Stock) and the volume of new production or issuance (Flow) over a specific period of time.

Network Security

Some argue that halvings enhance the security of the Bitcoin network. As the block rewards decrease, miners are incentivized to focus on transaction fees, which strengthens the financial viability of the network.