Crypto Fear and Greed Index

| Extreme Fear | 0-25 |

| Fear | 25-45 |

| Neutral | 45-55 |

| Greed | 55-75 |

| Extreme Greed | 75-100 |

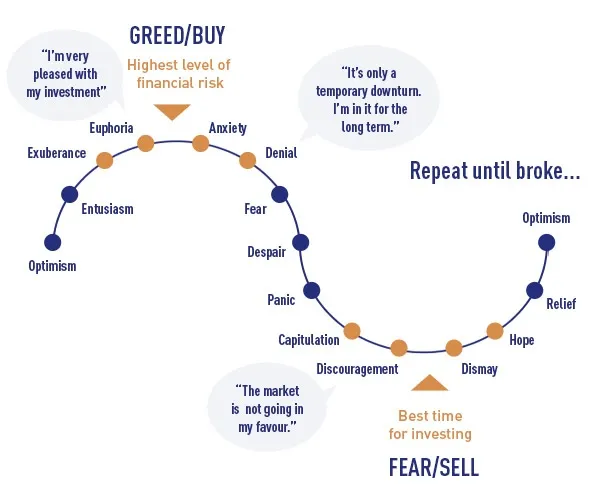

The crypto market is emotionally charged. Rising markets breed greed and FOMO, while downturns trigger irrational selling in response to red numbers. Our Fear and Greed Index shields you from emotional pitfalls, offering a balanced perspective to navigate market volatility.

Fear and Greed Index Chart

Why Assess Fear and Greed?

The cryptocurrency market is driven by intense emotions. Greed often arises during market upswings, fueling the Fear of Missing Out (FOMO). Conversely, panicked selling occurs in response to seeing red numbers. Our Fear and Greed Index aim to shield you from emotional impulses.

We operate based on two fundamental beliefs:

- Extreme fear may indicate excessive investor anxiety, potentially creating buying opportunities.

- Excessive investor greed may signal an imminent market correction.

Consequently, we evaluate the prevailing sentiment in the Bitcoin market, converting the data into a straightforward scale from 0 to 100. A score of zero indicates "Extreme Fear", while 100 signifies "Extreme Greed".

Data Sources

Data is sourced from five key outlets, with each data point holding consistent value compared to the preceding day to depict substantial shifts in crypto market sentiment.

Volatility (25%) - Current bitcoin volatility and maximum drawdowns are assessed against the 30-day and 90-day averages. Unusual spikes in volatility serve as indicators of a fearful market.

Market Momentum/Volume (25%) - The current volume and market momentum are measured against 30/90-day averages. Elevated buying volumes in a positive market are indicative of an overly greedy or bullish market.

Social Media (15%) - While the live Reddit sentiment analysis is pending, the active Twitter analysis tracks and quantifies posts with various hashtags for each coin, particularly Bitcoin. The rate and volume of interactions reflect increased public interest and signify a greedy market behavior.

Surveys (15%) - Currently paused. Utilizing strawpoll.com, a prominent public polling platform, weekly crypto polls provide insights into market sentiment, despite the current pause.

Dominance (10%) - Coin dominance reflects the market cap share of the entire crypto market. For Bitcoin, rising dominance may indicate a fear-driven reduction in speculative alt-coin investments. Conversely, decreasing dominance suggests increased greed, with investors turning to riskier alt-coins.

Trends (10%) - Google Trends data for various Bitcoin-related search queries is analyzed, focusing on changes in search volumes and popular recommended searches. For instance, a significant rise in searches for "bitcoin price manipulation" indicates market fear, contributing to the index."