Lido DAO LDO Price

- Optimism Ecosystem

- Ethereum Ecosystem

- Arbitrum Ecosystem

- Polygon Ecosystem

- Liquid Staking Governance Tokens

- Mantle Ecosystem

- Linea Ecosystem

- DePIN

- Friend.tech Ecosystem

- Manta Network Ecosystem

- Liquid Restaking Governance Tokens

- Paradigm Portfolio

- Coinbase Ventures Portfolio

- Index Coop Defi Index

- Gaming Utility Token

- Sports Games

- Simulation Games

- TON Meme

- Anime-Themed

- Bitlayer Ecosystem

- BEVM Ecosystem

- Alameda Research Portfolio

- DragonFly Capital Portfolio

- Andreessen Horowitz (a16z) Portfolio

- XRP Ledger Ecocystem

- Sora Ecosystem

- Polygon zkEVM Ecosystem

- Huobi ECO Chain Ecosystem

- Terra Classic Ecosystem

- Milkomeda (Cardano) Ecosystem

- Venture Capital Portfolios

- Secret Ecosystem

- Viction Ecocystem

- OKT Chain Ecosystem

- Oasis Emerald Ecosystem

- Bahamut Ecosystem

- Kucoin Community Chain Ecosystem

- opBNB Ecocystem

- LightLink Ecosystem

- Wanchain Ecosystem

- Conflux Ecosystem

- Waves Ecosystem

- Flare Network Ecosystem

- SmartBCH Ecosystem

- Boba Network Ecosystem

- EOS Ecosystem

- Rootstock Ecosystem

- Massa Ecosystem

- Oasys Ecosystem

- ThunderCore Ecosystem

- X Layer Ecosystem

- DFK Chain Ecosystem

- Songbird Ecosystem

- Hydra Ecosystem

- ShimmerEVM Ecosystem

- Migaloo Ecosystem

- Fraxtal Ecosystem

- NEO Ecosystem

- Elastos Smart Contract Chain Ecosystem

- BitTorrent Ecosystem

- Syscoin NEVM Ecosystem

- Astar zkEVM Ecosystem

- VeChain Ecosystem

- Bitrock Ecosystem

- Oasis Sapphire Ecosystem

- Meter Ecosystem

- Ethereum Classic Ecosystem

- Proof of Memes Ecosystem

- Ancient8 Ecosystem

- BounceBit Ecosystem

- Omnia Ecosystem

- Re.al Ecosystem

- Zedxion Ecosystem

- UTON Ecosystem

- Multicoin Capital Portfolio

- Nahmii Ecosystem

- Delphi Digital Portfolio

- Boba BNB Ecosystem

- Fantom Sonic Ecosystem

- Vyvo Smart Chain Ecosystem

- X1 Ecosystem

- Ethereum PoW IOU

- Celer Network

- GMCI DeFi Index

- Unicly Ecosystem

- KRW Stablecoin

- Infrastructure

- Pixels Game

- Animoca Brands Portfolio

- Parallel Ecosystem

- Puma Ecosystem

- Adidas Ecosystem

- PFP / Avatar

- Jack Butcher Ecosystem

- Nike Ecosystem

- Pudgy Ecosystem

- Berachain Ecosystem

- Mid-Cap PFP

- DeLabs

- Art Blocks Ecosystem

- Memeland Ecosystem

- eGirl Capital Portfolio

- NounsDAO

- Web 2 Brands

- F1 Partnership

- Large-Cap PFP

- Bored Ape Ecosystem

- Proof Ecosystem

- CyberKongz Ecosystem

- Ethereum PoS IOU

- Wolverine-Themed

- US Election 2020

- Niftex Shards

- Azuki Ecosystem

- GBP Stablecoin

- Remittance

- Doodles LLC

- OCM Ecosystem

- Haqq Network Ecosystem

- Investment

- AlienX Ecosystem

- Saakuru Ecosystem

- Cyber Ecosystem

- Mainnetz Ecosystem

- Etherlink Ecosystem

- Dex Aggregator

- Commodity-backed Stablecoin

- Algorithmic Stablecoin

- RWA Protocol

- Tokenized Real Estate

- Crypto-backed Stablecoin

- Index Coop DeFi Index

- Centralized Exchange (CEX) Token

- ASC-20

- Index Coop Index

- Centralized Finance (CeFi)

- Centralized Exchange (CEX) Product

- GMCI Index

- Index Coop Metaverse Index

- Fiat-backed Stablecoin

- Milady And Derivatives

- Synthetic

- HyperXpad Launchpad

- NFT Collections That Received Airdrops

- XT Smart Chain Ecosystem

- AI Applications

- Rari Ecosystem

- Cronos zkEVM Ecosystem

- Liquid Restaked SOL

- Liquid Restaked ETH

- Q Mainnet Ecosystem

- Gravity Alpha Ecosystem

- Sei v2 Ecosystem

- ENULS Ecosystem

- Moonchain Ecosystem

- Mint Ecosystem

- Jibchain Ecosystem

- Qitmeer Network Ecosystem

- Ham Ecosystem

- MaxxChain Ecosystem

- GraphLinq Ecosystem

- inEVM Ecosystem

- Alveychain Ecosystem

- Lung Ecosystem

- MultiVAC Ecosystem

- DefiMetaChain Ecosystem

- Larissa Ecosystem

- Combo Ecosystem

- PlatON Network Ecosystem

- Elysium Ecosystem

- Redstone Ecosystem

- Onchain Ecosystem

- Terraport Launchpad

- Flow EVM Ecosystem

- Zircuit Ecosystem

- Floor Protocol Tokens

- Index

- Liquid Staking

- OEC Ecosystem

- HECO Chain Ecosystem

- Edgeware Ecosystem

- Tenet Ecosystem

- Apex Chain Ecosystem

- Zano Ecosystem

- Governance

Lido DAO Price chart

Statistics

| Lido DAO Price $0.6036 | All-time high $7.3 | Days since ATH 1612 |

| Price change $0 (-0.0591%) | Date of ATH Aug 20, 2021 | % of ATH -91.72% |

Related cryptocurrencies

Lido DAO Review

Founded Date: Dec 17, 2022

Founders:

Co-founder & CEO

Co-founder

Co-founder & CTO

Lido DAO(LDO) - Coin Trading Data

| Lido DAO Price | $0.6036 |

| Ticker | LDO |

| Market Capitalization | $511.15M |

| Fully Diluted Valuation (FDV) | $603.79M |

| Value 24h low | $0.6018 |

| Value 24h high | $0.618 |

| Trade Volume for 24h | $22.36M |

| Current Circulating Supply | 846.57M |

| Maximum Supply | 1B |

| Algorithm | |

| ICO Price and ICO ROI | — |

| Price Change 24h % | -0.0591% |

| LDO quote | $0.6036 |

| Fully Diluted Valuation (FDV) | $603.79M |

Lido DAO(LDO) ATH - All Time High Price

| Lido DAO ATH Price | $7.3 |

| Days Since LDO ATH | 1612 |

| ATH Date | Aug 20, 2021 |

| All Time High % | -91.72% |

Lido Profile

Lido is a third-party stacking service that allows Ethereum users to place their ETH coins on Ethereum 2.0. It is worth noting that Lido allows users to place not only ETH 2.0, but also other crypto-assets such as bLuna or stSOL on the platform, with an annual interest rate of 3.3% to 6.4%, based on the asset.

The Lido project aims to allow investors the opportunity to make money from steaking without having large demands on capital and equipment. Lido removes the risks related to maintaining a stacking infrastructure by allowing users to contribute their assets in any amount to node operators. Another attractive feature of Lido DAO is that its platform is decentralized, in contrast to most other liquid-stacking platforms.

The main advantages of Lido are:

- Receiving rewards for your stake without blocking your capital completely.

- Freedom to receive rewards on Ethereum deposits smaller than 32 Ethereums and with no deposit restrictions.

- Reducing the risks of losing a staked deposit due to software failures or malicious third parties.

- Providing tokens as building blocks for other applications and protocols (e.g. as collateral for lending or other DeFi trading solutions).

- Enabling alternatives to exchange rates, self-stakes, and other semi-custodial and decentralized protocols.

Lido DAO

The Lido DAO is a decentralized, standalone organization that depends on the voting power of control token holders in order to establish key parameters. DAO is a bundle of service fees that can be spent on various activities on the platform, such as research, development, or protocol updates. Initially, DAO members can participate in threshold signatures for Ethereum 2.0 by creating BLS signatures so they can become part of the management.

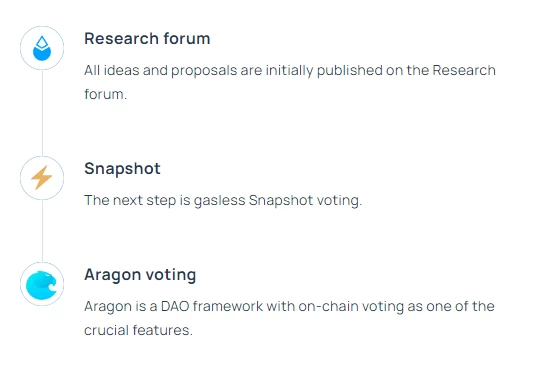

Lido Governance Process

In summary, the Lido DAO is committed to providing the following services:

- Launching Lido and setting up smart contracts for the protocol

- Configuring commissions and parameters for the protocol

- Assigning initial node operators, offering and updating Lido parameters, and implementations.

- Management of insurance, development funds and withdrawals.

- Selection of threshold signatures from reputable participants.

- Approving incentives for parties who have contributed to Lido DAO goals.

Lido DAO has become one of the most popular liquid staking platforms with over $13 billion in assets in one year since its inception. Originally developed with a focus on Ethereum, Lido is gradually expanding to other blockchain networks.

Lido DAO History

- In December 2020, the platform was launched on the main blockchain of Ethereum. At the same time, the team, which included Russian developers Konstantin Lomashuk and Vasily Shapovalov, launched the Lido DAO management token.

- In 2020, the team raised $2 million from ParaFi Capital, Semantic Ventures, Staking Facilities, and other major investors.

- In 2021, the Paradigm fund invested 15.12 thousand ETH in the development of the platform. In turn, KS1 contributed $15 million in exchange for LDO tokens.

- In 2022, the Andreessen Horowitz fund invested $70 million.

- Initially, clients were offered to stake on the Ethereum blockchain. Later, the creators added other networks. In 2023, users can stack these kinds of coins and tokens: Solana, KSM, Polkadot and Polygon.

- In 2023, after the Ethereum Shanghai update comes out, the developers plan to upgrade Lido to version 2.0.

LDO Mining

LDO cannot be mined: Lido is a liquid-stacking solution with the primary goal of giving users greater versatility for their stake assets, especially ETH stacks. Users can spend their purchased tokens to participate in DeFi applications in the Lido ecosystem and receive additional incentives.

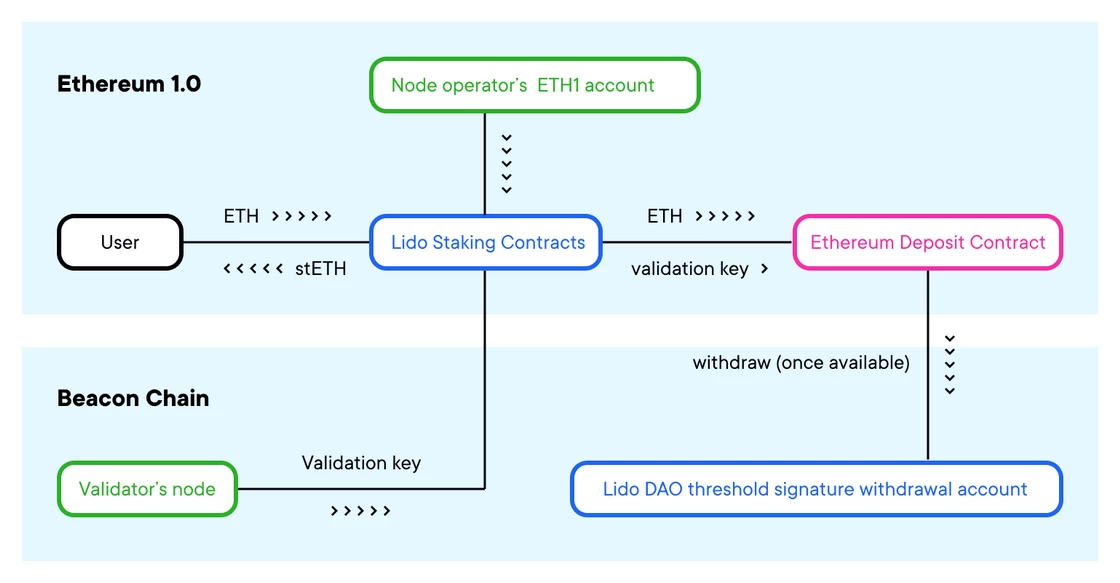

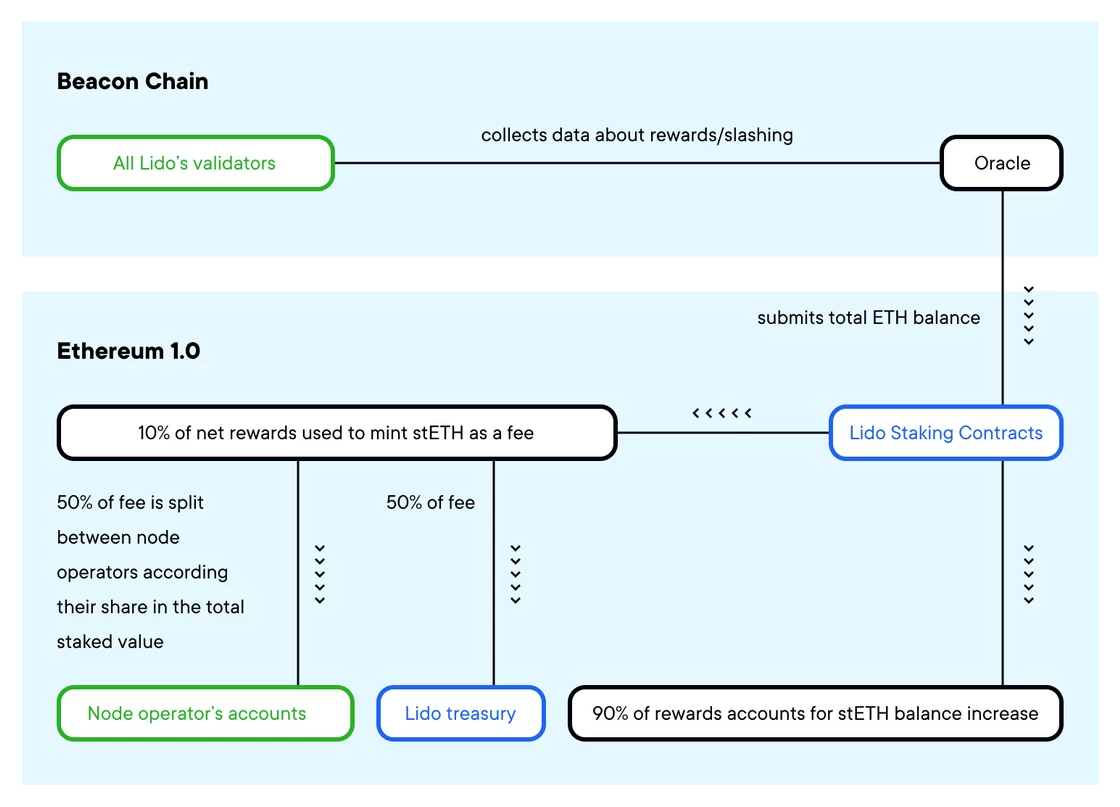

Staking pool is the core smart contract of Lido

Oracle Contract

LDO Stacking

Ethereum 2.0 accomplishes the transition from traditional Proof-of-Work consensus to the much more energy-efficient Proof-of-Stake mechanism. The Proof-of-Stake consensus model is based on block checking validators, which opens up the possibility of earning Ethereum cryptocurrency.

But users have to put at least 32 ETH to become a validator and get rewards for checking blocks, which is a very high barrier to entry. However, you can bypass it with a digital asset of Lido DAO token.

People who want to join Ethereum 2.0 staking must transfer their coins to the betting pool, and receive stETH tokens in return. The obtained Ethereum is distributed among the validators. Staking of other supported assets is performed in a similar scheme.

LDO Token

LDO is a service program's own token that is used to:

- Providing management rights to the Lido DAO.

- Managing the parameters and distribution of fees.

- Controlling the addition and removal of Lido node operators.

DAO defines key Lido parameters and performs Lido updates. Lido DAO members control Lido to ensure its efficiency and stability. You must own its management token, the LDO, to be eligible to vote in the Lido DAO.

The more LDO locked into a user's voting contract, the more decision-making power the voter has. Consequently, the more LDO tokens you have, the more voting power you will have. In addition, the LDO token voting mechanism is customizable and functions in tandem with other Lido protocols.

Lido Staking Problems in the U.S.

At the beginning of 2023, Provider Lido dominated the ETH stacking market with 29% of the total number of blocked ETHs. Cryptocurrency exchange Kraken was third in this ranking. But after a ban and a fine from the SEC, the company stops offering staking services in the United States. Bloomberg writes about it on February 12, 2023 and mentions an interview with the company's employee Jacob Blish.

Summary

Lido remains one of the most popular solutions for ETH stacking, and it ranks in the top five in terms of blocked funds. It offers high liquidity along with highest security. But it is still unknown how its success will be affected by its transition out of the U.S. market.

Q&A For Lido Cryptocurrency

How much is a one Lido DAO worth now?

1 Lido DAO worth $0.6036 now.

What is the price of LDO?

The price of LDO is $0.6036.

What is the Lido DAO max supply?

The max supply of Lido DAO is 1B.

What is the Lido DAO stock symbol or ticker?

The stock symbol or ticker of Lido DAO is LDO.

How many LDO coins are there in circulation?

There are 846.57M coins in circulation of LDO.

What is the exchange rate of Lido DAO(LDO)?

The exchange rate of Lido DAO is $0.6036.

What was Lido DAO's trading volume in 24 hours?

Lido DAO's 24-hour trading volume is $22.36M.

What was the highest price paid for Lido DAO?

Lido DAO reached a record high of $7.3 on Aug 20, 2021

Lido DAO Exchange Rates on Trading Markets

| # | Exchange | Pair | Price | 24h volume | Volume % | Updated | |

|---|---|---|---|---|---|---|---|

| 1 |

|

BitMart | LDO/USDT | $0.6029 | $3.09M | 13.36% | 3 minutes ago |

| 2 |

|

Poloniex | LDO/USDT | $0.601 | $1.86M | 8.05% | a minute ago |

| 3 |

|

Binance | LDO/USDT | $0.6029 | $1.86M | 8.03% | a minute ago |

| 4 |

|

WhiteBIT | LDO/USDT | $0.6076 | $1.42M | 6.13% | 9 minutes ago |

| 5 |

|

OrangeX | LDO/USDT | $0.6029 | $1.09M | 4.72% | 3 minutes ago |

| 6 |

|

CoinUp.io | LDO/USDT | $0.6019 | $852.61K | 3.69% | 9 minutes ago |

| 7 |

|

FameEX | LDO/USDT | $0.6029 | $697.48K | 3.02% | 10 minutes ago |

| 8 |

|

HTX | LDO/USDT | $0.6029 | $690.57K | 2.99% | 50 seconds ago |

| 9 |

|

Bybit | LDO/USDT | $0.6029 | $645.14K | 2.79% | a minute ago |

| 10 |

|

Uniswap V3 (Ethereum) | LDO/WETH | $0.6038 | $603.28K | 2.61% | 9 minutes ago |

| 11 |

|

Pionex | LDO/USDT | $0.6029 | $602.93K | 2.61% | 10 minutes ago |

| 12 |

|

Trubit | LDO/USDT | $0.6038 | $510.42K | 2.21% | 8 minutes ago |

| 13 |

|

OKX | LDO/USDT | $0.6029 | $495.18K | 2.14% | a minute ago |

| 14 |

|

Biconomy.com | LDO/USDT | $0.6029 | $461.62K | 2% | 11 minutes ago |

| 15 |

|

LBank | LDO/USDT | $0.6029 | $448.91K | 1.94% | 10 minutes ago |

| 16 |

|

Phemex | LDO/USDT | $0.6019 | $404.94K | 1.75% | 10 minutes ago |

| 17 |

|

Paribu | LDO/TRY | $0.601 | $350.19K | 1.51% | a minute ago |

| 18 |

|

Ourbit | LDO/USDT | $0.6019 | $332.25K | 1.44% | 9 minutes ago |

| 19 |

|

Hotcoin | LDO/USDT | $0.6029 | $332.06K | 1.44% | a minute ago |

| 20 |

|

Tapbit | LDO/USDT | $0.6029 | $329.37K | 1.42% | 4 minutes ago |