Aave AAVE Price

- Yield Farming

- Lending/Borrowing

- Optimism Ecosystem

- Ethereum Ecosystem

- Near Protocol Ecosystem

- Polygon Ecosystem

- Harmony Ecosystem

- BNB Chain Ecosystem

- Governance

- Fantom Ecosystem

- Avalanche Ecosystem

- Mantle Ecosystem

- Linea Ecosystem

- DePIN

- Friend.tech Ecosystem

- Manta Network Ecosystem

- Liquid Restaking Governance Tokens

- Index Coop Defi Index

- Gaming Utility Token

- Sports Games

- Simulation Games

- TON Meme

- Anime-Themed

- Bitlayer Ecosystem

- BEVM Ecosystem

- XRP Ledger Ecocystem

- Sora Ecosystem

- Polygon zkEVM Ecosystem

- Huobi ECO Chain Ecosystem

- Terra Classic Ecosystem

- Milkomeda (Cardano) Ecosystem

- Venture Capital Portfolios

- Secret Ecosystem

- Viction Ecocystem

- OKT Chain Ecosystem

- Oasis Emerald Ecosystem

- Bahamut Ecosystem

- Kucoin Community Chain Ecosystem

- opBNB Ecocystem

- LightLink Ecosystem

- Wanchain Ecosystem

- Conflux Ecosystem

- Waves Ecosystem

- Flare Network Ecosystem

- SmartBCH Ecosystem

- Boba Network Ecosystem

- EOS Ecosystem

- Rootstock Ecosystem

- Massa Ecosystem

- Oasys Ecosystem

- ThunderCore Ecosystem

- X Layer Ecosystem

- DFK Chain Ecosystem

- Songbird Ecosystem

- Hydra Ecosystem

- ShimmerEVM Ecosystem

- Migaloo Ecosystem

- Fraxtal Ecosystem

- NEO Ecosystem

- Elastos Smart Contract Chain Ecosystem

- BitTorrent Ecosystem

- Syscoin NEVM Ecosystem

- Astar zkEVM Ecosystem

- VeChain Ecosystem

- Bitrock Ecosystem

- Oasis Sapphire Ecosystem

- Meter Ecosystem

- Ethereum Classic Ecosystem

- Proof of Memes Ecosystem

- Ancient8 Ecosystem

- BounceBit Ecosystem

- Omnia Ecosystem

- Re.al Ecosystem

- Zedxion Ecosystem

- UTON Ecosystem

- Nahmii Ecosystem

- Blockchain Capital Portfolio

- Boba BNB Ecosystem

- Fantom Sonic Ecosystem

- Vyvo Smart Chain Ecosystem

- X1 Ecosystem

- Ethereum PoW IOU

- Celer Network

- GMCI DeFi Index

- Unicly Ecosystem

- KRW Stablecoin

- Pixels Game

- Animoca Brands Portfolio

- Parallel Ecosystem

- Puma Ecosystem

- Adidas Ecosystem

- PFP / Avatar

- Jack Butcher Ecosystem

- Nike Ecosystem

- Pudgy Ecosystem

- Berachain Ecosystem

- Mid-Cap PFP

- DeLabs

- Art Blocks Ecosystem

- Memeland Ecosystem

- NounsDAO

- Web 2 Brands

- F1 Partnership

- Large-Cap PFP

- Bored Ape Ecosystem

- Proof Ecosystem

- CyberKongz Ecosystem

- Ethereum PoS IOU

- Wolverine-Themed

- US Election 2020

- Niftex Shards

- Azuki Ecosystem

- GBP Stablecoin

- Remittance

- Doodles LLC

- OCM Ecosystem

- Haqq Network Ecosystem

- Investment

- AlienX Ecosystem

- Saakuru Ecosystem

- Cyber Ecosystem

- Mainnetz Ecosystem

- Etherlink Ecosystem

- Dex Aggregator

- Commodity-backed Stablecoin

- Algorithmic Stablecoin

- RWA Protocol

- Tokenized Real Estate

- Crypto-backed Stablecoin

- Index Coop DeFi Index

- Centralized Exchange (CEX) Token

- ASC-20

- Index Coop Index

- Centralized Finance (CeFi)

- Centralized Exchange (CEX) Product

- GMCI Index

- Index Coop Metaverse Index

- Fiat-backed Stablecoin

- Milady And Derivatives

- Synthetic

- HyperXpad Launchpad

- NFT Collections That Received Airdrops

- XT Smart Chain Ecosystem

- AI Applications

- Rari Ecosystem

- Cronos zkEVM Ecosystem

- Liquid Restaked SOL

- Liquid Restaked ETH

- Q Mainnet Ecosystem

- Gravity Alpha Ecosystem

- Sei v2 Ecosystem

- ENULS Ecosystem

- Moonchain Ecosystem

- Mint Ecosystem

- Jibchain Ecosystem

- Qitmeer Network Ecosystem

- Ham Ecosystem

- MaxxChain Ecosystem

- GraphLinq Ecosystem

- inEVM Ecosystem

- Alveychain Ecosystem

- Lung Ecosystem

- MultiVAC Ecosystem

- DefiMetaChain Ecosystem

- Larissa Ecosystem

- Combo Ecosystem

- PlatON Network Ecosystem

- Elysium Ecosystem

- Redstone Ecosystem

- Onchain Ecosystem

- Terraport Launchpad

- Flow EVM Ecosystem

- Energi Ecosystem

- Arbitrum Ecosystem

- Zircuit Ecosystem

- Floor Protocol Tokens

- Index

- OEC Ecosystem

- HECO Chain Ecosystem

- Edgeware Ecosystem

- Tenet Ecosystem

- Apex Chain Ecosystem

- Zano Ecosystem

- Base Ecosystem

- Stablecoin Protocol

- AAVE/USDC

- AAVE/USD

- AAVE/EUR

- AAVE/BTC

- AAVE/TRY

- AAVE/KRW

- AAVE/GBP

- AAVE/ETH

- AAVE/WETH

- AAVE/WETH

- AAVE/XRP

- AAVE/WETH

- AAVE/PLN

- AAVE/WETH

- AAVE/UNI

- AAVE/FDUSD

- AAVE/PHP

- AAVE/IDR

- AAVE/LINK

- AAVE/WBNB

- AAVE/WPOL

- AAVE/USDC.E

- AAVE/BSC-USD

- AAVE/WETH

- AAVE/USDT0

- AAVE/BRL

- AAVE/WAVAX

- AAVE/INR

- AAVE/THB

- AAVE/BNT

- AAVE/AUD

- AAVE/RUNE

- AAVE/SGD

- AAVE/NZD

- AAVE/WBTC

- AAVE/TEL

- AAVE/ZIK

- AAVE/BAL

- AAVE/GTC

- AAVE/RPL

- AAVE/WNRG

- AAVE/MYR

- AAVE/WAETHUSDC

- AAVE/WBTC

- AAVE/MORPHO

- AAVE/USDT

- AAVE/USDT

- AAVE/WFTM

- AAVE/VNST

Aave Price chart

Statistics

| Aave Price $173.26 | All-time high $661.69 | Days since ATH 1706 |

| Price change -$1.652 (-0.9449%) | Date of ATH May 18, 2021 | % of ATH -73.81% |

Related cryptocurrencies

Aave Review

Aave(AAVE) - Coin Trading Data

| Aave Price | $173.26 |

| Ticker | AAVE |

| Market Capitalization | $2.63B |

| Fully Diluted Valuation (FDV) | $2.77B |

| Value 24h low | $172.41 |

| Value 24h high | $176.42 |

| Trade Volume for 24h | $201.06M |

| Current Circulating Supply | 15.18M |

| Maximum Supply | 16M |

| Algorithm | |

| ICO Price and ICO ROI | 0.017 USD 10191.76x |

| Price Change 24h % | -0.9449% |

| AAVE quote | $173.26 |

| Fully Diluted Valuation (FDV) | $2.77B |

Aave(AAVE) ATH - All Time High Price

| Aave ATH Price | $661.69 |

| Days Since AAVE ATH | 1706 |

| ATH Date | May 18, 2021 |

| All Time High % | -73.81% |

Aave Profile

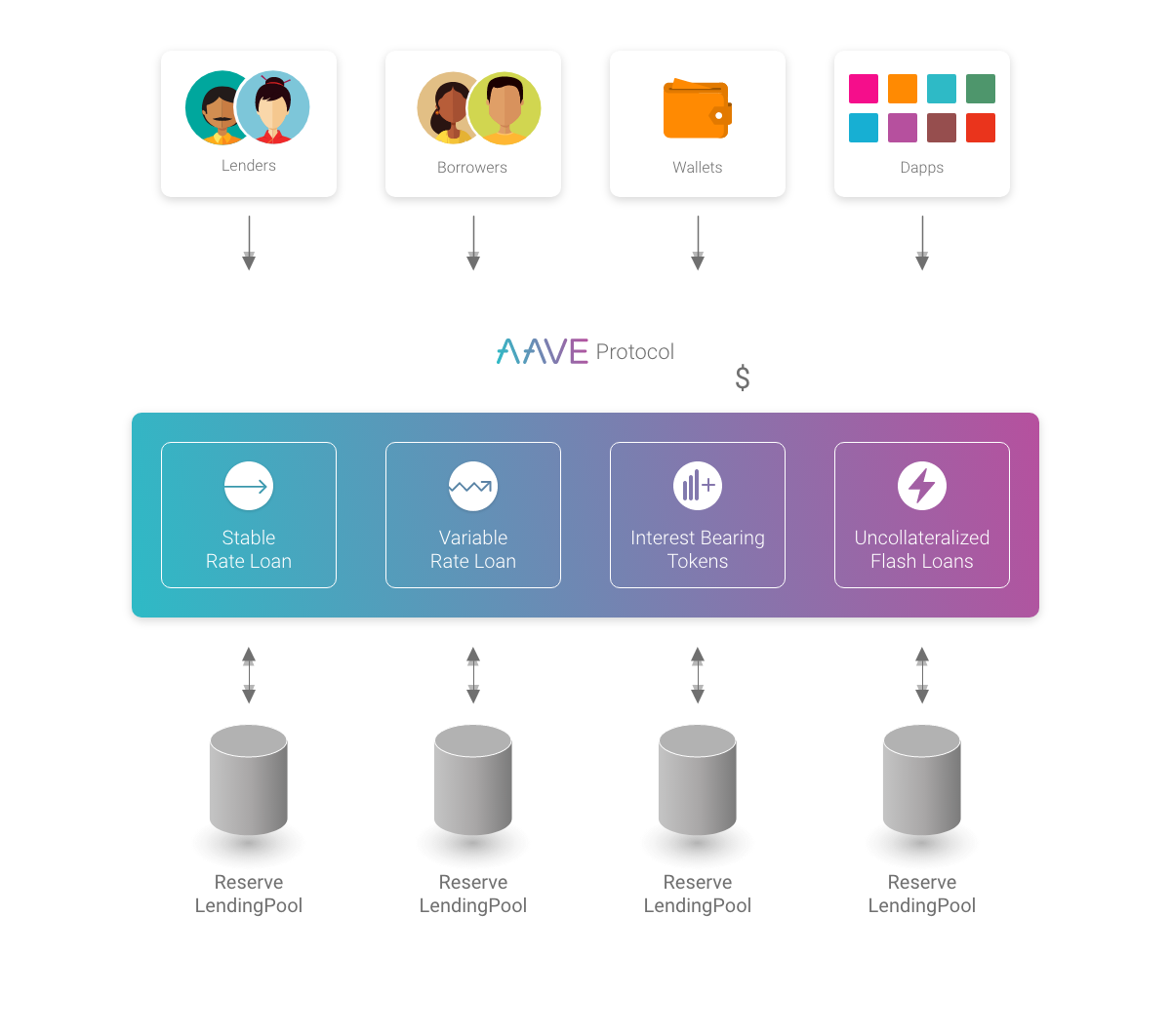

The Aave network is a decentralized finance (DeFi) protocol that allows people to lend and borrow cryptocurrencies and real-world assets without having to deal with a centralized intermediary. At the same time, Aave uses a combination of fixed and variable rates of interest.

Simply put, Aave allows users to lend and borrow cryptocurrency in a decentralized and credibility-free way. The platform has no middlemen, and you don't have to provide any documents or go through Know Your Customer or Anti Money Laundering procedures to use it.

Lenders place their funds in a "pool" from which users can lend. Each pool allocates a small percentage of assets as reserves to help hedge against any volatility within the protocol. It also allows lenders to withdraw their funds at any time.

Depositors can help provide liquidity to the market while getting a second income, while borrowers are allowed to take credits with excess collateral (perpetual) or with insufficient collateral (single-block liquidity).

Features of Aave:

- The protocol is designed as a set of smart contracts on the Ethereum blockchain. Smart contracts provide security and no intermediary is necessary.

- User funds are not controlled by a third party and the process is fully decentralized.

- With the Aave token, you can get a discount on the interest on loans or increase the interest on a deposit, among several other advantages.

- There is an insurance fund that will collect a small portion of the pool's income to cover losses in the event of liquidation issues.

- Aave provides term loans: these are credits that need to be paid back within a short time.

AAVE Overview

Aave's Operating Principles

Owners of digital assets can participate as depositors or borrowers. Depositors contribute digital coins to the pool, so they are lenders. On the other side of the platform are borrowers, who can request a cryptocurrency loan and get it very quickly.

To borrow cryptocurrency, you need to deposit another one, the total value of which must be higher in dollar equivalent. Additionally, you pay an interest rate, which is based on the supply and demand ratio of the borrowed asset.

Borrowers must always monitor that their collateral has not been liquidated. This happens if the value of the collateral along with the accrued interest is less than the value of the borrowed cryptocurrency.

Aave's History

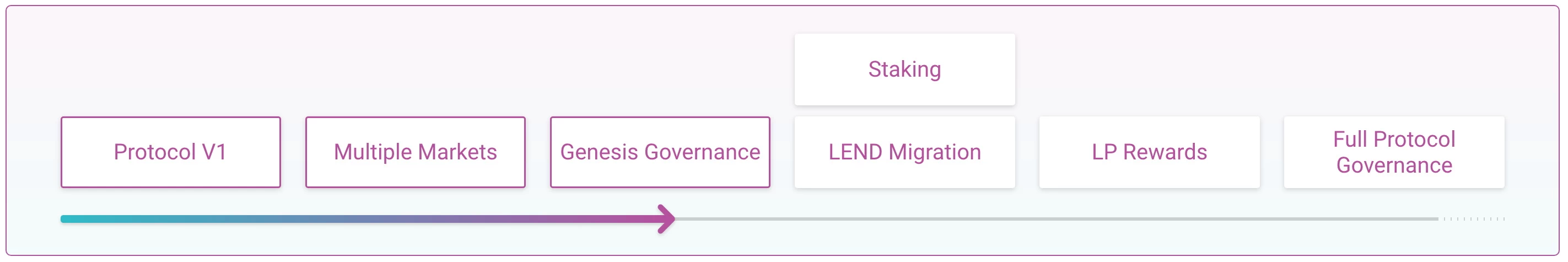

- In 2017, this platform was launched under the name ETHLend; in November, they held an ICO that raised $600,000.

- In September 2018, it was rebranded because of the addition of new features, in particular, operations with Bitcoin.

- In 2019, the developers abandoned the system of P2P approvals of loan agreements and launched a pool of decentralized assets. Lenders became liquidity providers, generating passive income without having to keep track of payments and liquidations, and borrowers became able to deposit collateral into the protocol and receive loans instantly.

- In 2020, LEND tokens in the amount of 1.3 billion units were converted into cryptocurrency coin AAVE at a ratio of 100:1.

- In 2021, the project managed to establish itself among the leaders of the crypto market when it comes to providing users with credit funds.

- In 2023, Aave's DeFi-platform will begin the first phase of a "rescue mission" for tokens lost as a result of being sent to incorrect smart contracts. This proposal has received a 100% support vote.

AAVE's Roadmap

Aave Interest Rates

Aave offers two types of interest rates: stable and floating. A floating interest rate is calculated automatically based on the pool utilization rate (in other words, demand), with an increase in the pool utilization rate leading to an increase in interest rates for both lenders and borrowers.

The stable interest rate is the average interest rate on an asset over the past thirty days. You can view your interest rate history the moment you make or take a loan on the platform. You can switch between stable and variable rates at any time (you will only have to pay a small ETH gas fee).

Aave Token

Aave cryptocurrency is a token of the same name ( former LAND or LEND) for DeFi services. It provides the ability to borrow money anonymously.

Because AAVE is an ERC-20 token, it can be saved in almost any cryptocurrency wallet that supports Ethereum. You can become an owner of a token by buying it on a cryptocurrency exchange or exchanging it at special online services.

Сryptocurrency is used in the protocol as a management tool. Holders can make votes and propose their own changes to the Aave protocol. In order to prevent inflation, the system will charge a fee to pool participants to buy tokens on the market and burn them.

Interest tokens are minted for deposit and burned when redeemed. Tokens are pegged 1:1 to the value of the underlying asset, which is deposited in the Aave protocol.

You can make a profit with an Aave token in three ways:

- Investment.

- Active trading.

- Stacking.

Aave Pay

With the Aave Pay app you can make payments in fiat currency, which is converted into cryptocurrencies at the average exchange rate. The app allows you to pay in U.S. dollars, euros, and British pounds. In addition to the pool tokens, you can pay in Bitcoin, Ethereum and other major altcoins.

Advantages and Disadvantages of AAVE

At the moment Aave is quite successful, but still has some weaknesses.

| Advantages | Disadvantages |

|---|---|

| Maintaining stable and competitive prices | The use of the Ethereum blockchain network results in higher fees for transactions in AAVE |

| Providing support during the initial formation of the DeFi industry | Crypto volatility that makes it difficult to accurately predict the value of the coin |

| Wide range of cryptocurrencies that can be used for lending and borrowing in the crypto format | |

| Availability of a wide selection of advanced modern DeFi products that are considered to be among the best products inside a specified industry |

Summary

Aave's main advantage is its maximum decentralization. Unlike its competitors, this lending platform does not represent a regulated body, storing users' funds and transmitting reports to the authorities, but offers the possibility to perform financial transactions confidentially and with a minimum of risk.

When compared to other DeFi lending protocols, Aave offers a bundle of features, assets and development tools that allow other developers to implement the same features in their own projects.

How much is a one Aave worth now?

1 Aave worth $173.26 now.

What is the price of AAVE?

The price of AAVE is $173.26.

What is the Aave max supply?

The max supply of Aave is 16M.

What is the Aave stock symbol or ticker?

The stock symbol or ticker of Aave is AAVE.

How many AAVE coins are there in circulation?

There are 15.18M coins in circulation of AAVE.

What is the exchange rate of Aave(AAVE)?

The exchange rate of Aave is $173.26.

What was Aave's trading volume in 24 hours?

Aave's 24-hour trading volume is $201.06M.

What was the highest price paid for Aave?

Aave reached a record high of $661.69 on May 18, 2021

Aave Exchange Rates on Trading Markets

| # | Exchange | Pair | Price | 24h volume | Volume % | Updated | |

|---|---|---|---|---|---|---|---|

| 1 |

|

CoinUp.io | AAVE/USDT | $173.14 | $303.22M | 56.31% | 4 minutes ago |

| 2 |

|

BVOX | AAVE/USDT | $173.29 | $41.4M | 7.69% | 8 minutes ago |

| 3 |

|

FameEX | AAVE/USDT | $173.11 | $34.19M | 6.35% | 2 minutes ago |

| 4 |

|

Bybit | AAVE/USDT | $173.02 | $30.92M | 5.74% | a minute ago |

| 5 |

|

GroveX | AAVE/USDT | $173.52 | $19.85M | 3.69% | 8 minutes ago |

| 6 |

|

Zoomex | AAVE/USDT | $173.3 | $12.3M | 2.28% | 7 minutes ago |

| 7 |

|

Poloniex | AAVE/USDT | $173.17 | $7.97M | 1.48% | 5 minutes ago |

| 8 |

|

Binance | AAVE/USDT | $173.15 | $5.76M | 1.07% | 3 minutes ago |

| 9 |

|

Hotcoin | AAVE/USDT | $173.16 | $4.23M | 0.79% | 4 minutes ago |

| 10 |

|

WhiteBIT | AAVE/USDT | $174.28 | $4.18M | 0.78% | 3 minutes ago |

| 11 |

|

BingX | AAVE/USDT | $173.04 | $3.77M | 0.7% | 3 minutes ago |

| 12 |

|

MEXC | AAVE/USDT | $173.33 | $3.52M | 0.65% | 8 minutes ago |

| 13 |

|

Coinbase Exchange | AAVE/USD | $173.13 | $3.44M | 0.64% | 3 minutes ago |

| 14 |

|

Websea | AAVE/USDT | $173.07 | $3.22M | 0.6% | 27 seconds ago |

| 15 |

|

AscendEX (BitMax) | AAVE/USDT | $172.89 | $2.92M | 0.54% | 2 minutes ago |

| 16 |

|

Trubit | AAVE/USDT | $173.29 | $2.62M | 0.49% | 6 minutes ago |

| 17 |

|

CoinW | AAVE/USDT | $173.01 | $2.56M | 0.48% | 2 minutes ago |

| 18 |

|

OKX | AAVE/USDT | $173.09 | $2.15M | 0.4% | a minute ago |

| 19 |

|

Hibt | AAVE/USDT | $173.29 | $2.08M | 0.39% | 8 minutes ago |

| 20 |

|

P2B | AAVE/USDT | $173.43 | $2.03M | 0.38% | 10 minutes ago |