Next Litecoin Halving Countdown For 2027

Litecoin Halvings Chart

Let's delve into the details of the Litecoin halving, step by step, including any necessary tables for clarity:

Introduction to Litecoin (LTC)

Litecoin is a popular cryptocurrency created by Charlie Lee in 2011 as a fork of the Bitcoin protocol. Its key features are a shorter block generation time and a different hashing algorithm (Scrypt). Like Bitcoin, Litecoin also experiences a halving event to manage its supply and maintain scarcity.

Litecoin Halving Schedule

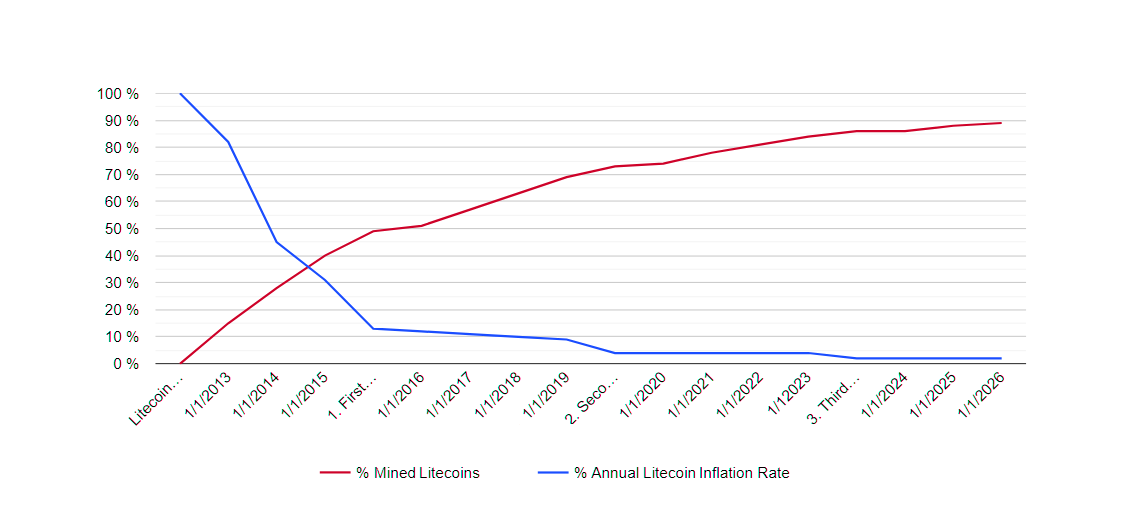

Litecoin's halving events occur roughly every four years, or after 840,000 blocks have been mined. The schedule is designed to ensure that the total supply of Litecoin remains capped at 84 million coins, four times the supply limit of Bitcoin.

Now, let's break down the nuances of the Litecoin halving:

| Halving Event | Block Number | Approx. Date | Block Reward Before Halving (LTC) | Block Reward After Halving (LTC) |

|---|---|---|---|---|

| 1st Halving | 0 - 840,000 | August 25, 2015 | 50 | 25 |

| 2nd Halving | 840,000 - 1,680,000 | August 5, 2019 | 25 | 12.5 |

| 3rd Halving | 1,680,000 - 2,520,000 | August 2, 2023 | 12.5 | 6.25 |

| 4th Halving | 2,520,000 - ... | Expected 30 Jul 2027 | 6.25 | 3.125 |

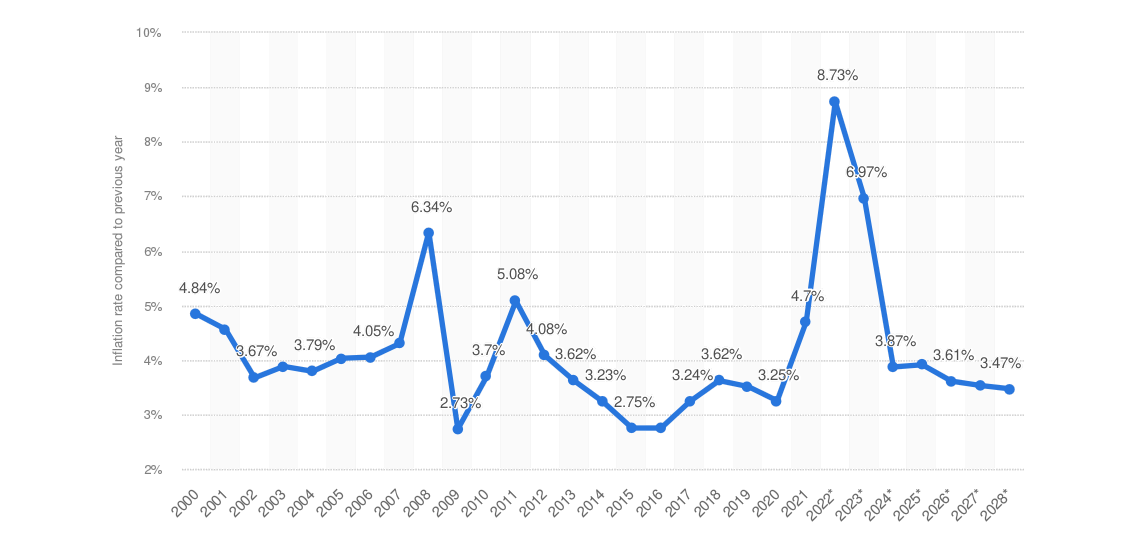

Purpose of Halving

The primary purpose of the Litecoin halving is to control inflation and regulate the issuance of new coins. By cutting the block reward in half at each halving, Litecoin reduces the rate at which new coins are introduced into circulation, gradually reducing supply growth over time.

Global inflation rate from 2000 to 2028

Litecoin Inflation Rate VS Litecoin Supply

Impact on Miners

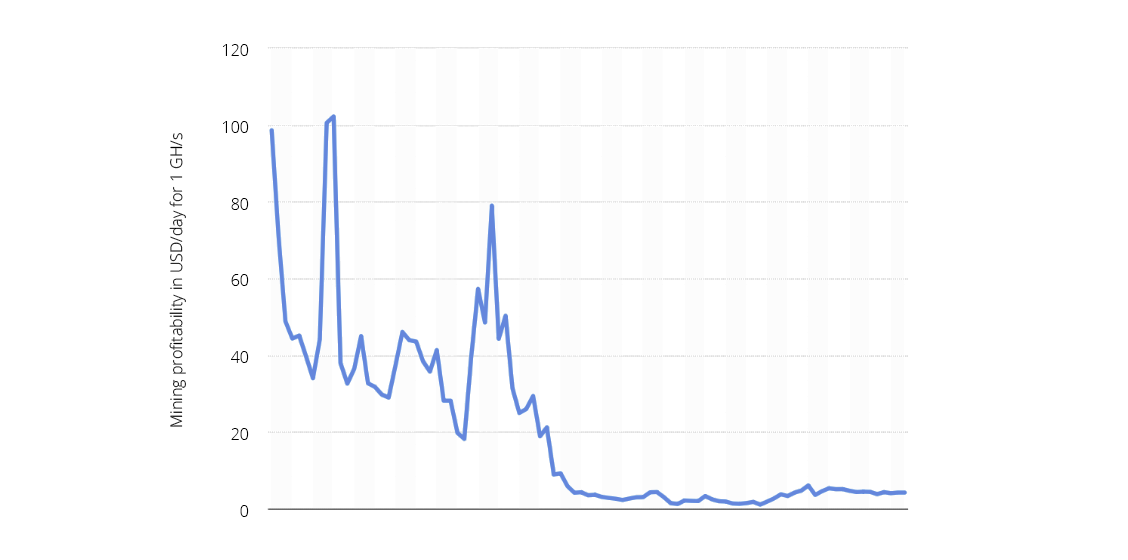

Miners play a crucial role in securing the Litecoin network. When a halving occurs, miners see a significant reduction in their rewards for adding new blocks to the blockchain. This can affect the profitability of mining operations, making it essential for miners to operate efficiently and for Litecoin's price to compensate for the reduced rewards.

Mining profitability of Litecoin per day from 2014 to 2021

Market Expectations

Halving events often generate considerable attention and speculation in the cryptocurrency community. There are expectations that a reduced rate of new coin issuance could drive up demand for Litecoin, potentially impacting its price positively. However, market dynamics, sentiment, and external factors influence price movements.

I can see an upside target of 10% (0.025 LTC/BTC). In the next bull market, 5% (0.0125) shouldn't be too hard to achieve. I honestly don't see it going much below 1% (0.0025) on the downside. The next halving will be in ~92 days. This is going to be fun.

Historical Performance

Looking at previous Litecoin halvings, it's important to note that past performance doesn't guarantee future outcomes. However, both previous halving events did coincide with substantial price rallies in Litecoin, although this is no guarantee of future performance.

Long-Term Implications

The Litecoin halving mechanism aims to create a deflationary environment over time, potentially increasing the scarcity of coins. If demand for Litecoin remains steady or increases, this reduction in supply growth could exert upward pressure on the price.