Next Dash Halving Countdown For 2026

Let's delve into the technical details of the Dash halving, step by step, including any necessary tables for clarity:

Introduction to Dash (DASH)

Dash is a cryptocurrency that was originally launched as "Xcoin" in January 2014 but later rebranded as Dash, which stands for "Digital Cash." It is known for its focus on fast and low-cost transactions, as well as its unique two-tier network with miners and masternodes. Like many cryptocurrencies, Dash has a halving event to control its supply and maintain scarcity.

Dash Halving Schedule

Dash's halving events occur approximately 7.14% of every 210,240 blocks, which is roughly every 383 days. Unlike some other cryptocurrencies that have a fixed block reward reduction, Dash's halving is based on the preceding 210,240 blocks. Below is a breakdown of Dash's halving schedule:

Purpose of Halving

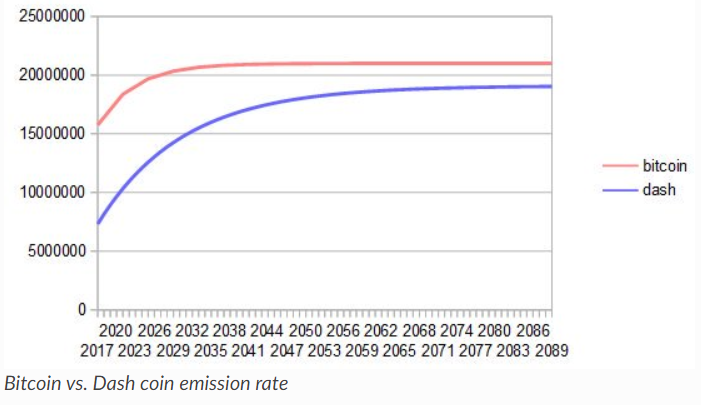

The primary purpose of Dash's halving is to manage inflation and regulate the issuance of new coins. By reducing the block reward by half based on the previous 210,240 blocks, Dash gradually decreases the rate at which new coins are introduced into circulation, contributing to controlled supply growth.

Impact on Miners

Miners are integral to securing the Dash network. When a halving event occurs, miners experience a significant reduction in their rewards for successfully mining blocks. This can impact the profitability of mining operations, incentivizing miners to operate efficiently and potentially leading to changes in the network's overall hashrate.

Market Expectations

Halving events often attract attention and speculation from the cryptocurrency community. There is an expectation that the reduction in the rate of new coin issuance might increase demand for Dash, potentially influencing its price positively. However, it's important to acknowledge that market dynamics, sentiment, and external factors also play significant roles in price movements.

Historical Performance

In the past, Dash's halving events have generally coincided with periods of increased market interest and price appreciation. However, past performance does not guarantee future results, and the cryptocurrency market is known for its volatility.

Long-Term Implications

The Dash halving mechanism aims to create a deflationary environment over time. If demand for Dash remains stable or increases, the reduced supply growth could exert upward pressure on its price, contributing to its overall scarcity.