Finding the best DeFi staking platform can seriously level up your passive income game in crypto. But with so many options out there—some solid, others sketchy—it’s easy to get overwhelmed.

That’s why this guide cuts through the noise. You’ll get the inside scoop on top-tier platforms like Margex and MEXC, with a breakdown of what really matters: staking yields, fees, security protocols, supported assets, and how smooth the user experience actually is.

Whether you’re stacking $ETH, $USDT, or diving into staking for top altcoins, you’ll know exactly where your crypto is safest—and earning consistently strong returns.

This isn’t just about finding a platform. It’s about locking in the one that fits your strategy and helps your portfolio grow on autopilot.

Stick around—we’re about to unpack the best staking platforms so you can start earning more from your holdings without breaking a sweat.

Best DeFi Staking Platform in 2025 Reviewed

Let’s dive into our review of the best DeFi staking platform for 2025, where we break down the top platforms to help you find the perfect staking opportunity. Here’s a quick overview:

- BingX — Seamless DeFi staking with fixed-rate returns and low-risk yield strategies.

- Bybit — Unified platform for staking, spot, and futures with guaranteed asset security

- Binance — Deep liquidity and flexible DeFi staking for both fixed and launchpool rewards

- Blofin — Futures-focused staking backed by AI-driven security and trading infrastructure

- OKX — DeFi staking hub with multichain access and seamless Web3 wallet integration

- MEXC — Earn with high-APY DeFi staking and auto-compounding across trending tokens

- Margex — Fixed staking returns with zero slippage and institutional-grade protection

Why Use a DeFi Staking Platform?

Staking platforms let your crypto work for you—literally. You lock in your assets, and in return, you earn passive income. It’s one of the smartest plays for long-term holders who want to grow their stack without constantly watching the charts.

By staking, you’re not just sitting on your bags—you’re actually helping secure the network and getting rewarded for it.

Most DeFi platforms offer solid APYs, support multiple tokens like $ETH, $SOL, or $USDT, and keep fees low, which gives you the freedom to diversify without draining your profits.

It’s hands-off, scalable, and often way more rewarding than just leaving your coins idle in a crypto wallet.

Still, don’t skip the homework—understanding the trade-offs, like lock-up periods or protocol risks, will keep your game sharp and your capital safer.

Pros

- Turn idle tokens into yield machines for consistent income streams

- Low-cost access to compounding returns to maximize your yields

- Stake across trending and emerging tokens for early exposure to good projects

- Pick your strategy: flexible or fixed terms for complete staking freedom

- Keep custody while earning for extra security

Cons

- Rewards can fluctuate—or dry up completely

- Volatility doesn’t pause when you stake

- Customer support can be a hit or miss on some platforms

Staking exchanges can seriously boost your passive income game—but don’t dive in blind. It’s all upside when things go smooth, but like anything in crypto, there’s risk under the hood.

Know the trade-offs, stack the pros against the cons, and make sure the move aligns with your strategy—not just the hype.

7. BingX

BingX makes DeFi staking stupid simple with a fixed-rate savings model that’s low on risk and high on chill.

Whether you’re new to crypto staking platforms or just don’t have time to babysit your yield farm, BingX’s ‘Savings’ feature offers fixed returns on top assets like Bitcoin ($BTC), Ethereum ($ETH), and Tether ($USDT)—with APYs that range from modest to downright wild.

Some assets like $APFC land in the mid-high tier (25–50%), so there’s something for every kind of yield hunter. Payouts hit daily, and lock-up periods are short—making this one of the most accessible and rewarding crypto staking platforms out there.

But BingX isn’t just for staking. It’s a full-featured exchange with clean UX, high liquidity, and tools like copy trading and grid bots. It supports a wide asset list (think $ADA, $APT, $XRP), and balances beginner-friendliness with pro-grade features.

Security-wise, BingX is built for trust—regulated across multiple regions with transparent proof-of-reserves. That’s peace of mind while your assets work overtime.

| Feature | Details |

| Type | Centralized |

| Cryptocurrency Support | Bitcoin, Ethereum, Solana, ADA, APT |

| Staking | ✅ (BTC up to 100%, SOL up to 20%, PARTI up to 500%) |

| Other Noteworthy Perks | Flexible fixed-rate savings, daily rewards, built-in copy trading tools |

6. Bybit

Bybit brings everything under one roof—staking, spot, and futures trading—all backed by bank-grade security. If you’re after a reliable and unified platform with serious earning potential, this one hits the mark.

What gives Bybit an edge among the best DeFi platforms for staking is how it balances risk and reward. You’ll find everything from low-risk stablecoin savings to higher-yield plays like $COMP (49.4%) or $TAIKO (42%).

Plus, rewards are clearly labeled, durations are transparent, and all the terms are upfront—so you always know exactly what you’re locking into.

The exchange itself is also sleek and powerful. With deep liquidity, fast order execution, and advanced tools like grid trading bots and copy trading, it caters to both casual users and power traders.

It also supports a unified trading account—making portfolio management across multiple crypto services seamless.

Moreover, security is one of the best we’ve seen across exchanges. With real-time proof-of-reserves, ISO-compliance, and rigorous asset protection protocols, you’re covered on all fronts.

Overall, Bybit is the kind of platform where ease, control, and earning potential actually go hand in hand.

| Feature | Details |

| Type | Centralized |

| Cryptocurrency Support | Bitcoin, Ethereum, USDT, COMP, TAIKO |

| Staking | ✅ (USDT up to 555%, ETH 3%, COMP 49.4%) |

| Other Noteworthy Perks | Unified trading account, AI-driven tools (TradeGPT), automated trading bots |

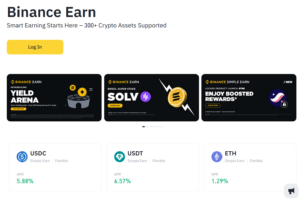

5. Binance

Binance nails it as a powerhouse for staking and trading, giving you deep liquidity and flexible DeFi staking in one polished platform. Whether you’re into short-term flips or long-term holds, Binance Earn has options that hit both ends of the spectrum.

You can stake blue-chip assets like $BTC, $ETH, and $SOL with APRs reaching up to 204%—yes, you read that right. Both flexible and locked-term products are available, so you can dial in the yield-to-liquidity balance however you like.

That’s especially sweet for passive income fans who want more compounding, less clicking. And if you’re curious about how staking works without all the guesswork, Binance gives clean APR breakdowns and projections, so you’re never flying blind.

Add in the platform’s heavyweight trading tools—spot, futures, launchpad, and bots—and you’re looking at one of the most comprehensive crypto ecosystems around.

And last but not least, security is handled with institutional-grade measures, including SAFU insurance, proof-of-reserves, and 24/7 threat monitoring. So you’re not just earning; you’re earning safely.

| Feature | Details |

| Type | Centralized |

| Cryptocurrency Support | Bitcoin, Ethereum, Solana, BNB, FDUSD |

| Staking | ✅ (SOL up to 204.7%, ETH up to 192.6%, USDT 6.6%) |

| Other Noteworthy Perks | Auto-compounding, dual staking modes, DeFi & Launchpool access |

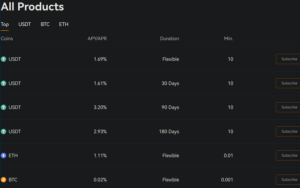

4. BloFin

BloFin blends futures-focused precision with easy passive income through its streamlined crypto staking platform. Built around AI-driven infrastructure, it’s engineered for security and performance—giving you the confidence to stake without compromise.

If you’re searching for one of the best crypto staking platforms that doesn’t force you to choose between high-level trading and reliable staking rewards, BloFin deserves a close look.

The platform’s flexible durations and low minimums (as little as 0.001 $BTC or 10 $USDT) mean even casual investors can get in the game without overcommitting.

Security isn’t just a checkbox here—it’s a core focus. BloFin’s AI-driven threat detection and real-time monitoring tech keep your assets under constant protection, all while maintaining smooth performance.

And with an interface that’s as sleek as it is simple, even new users can explore how staking works without any friction.

Add on its zero-fee futures promo, deep liquidity pools, and growing suite of financial products, and BloFin positions itself as a serious contender for long-term staking and pro trading alike.

| Feature | Details |

| Type | Centralized |

| Cryptocurrency Support | BTC, ETH, USDT, USDC, BNB |

| Staking | ✅ (USDT 3.2%, ETH 1.11%, BTC 0.02%) |

| Other Noteworthy Perks | AI-based security, low staking minimums, futures-trading integration |

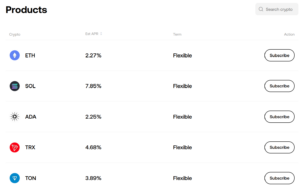

3. OKX

OKX brings multichain staking and powerful DeFi tools together in one clean and connected ecosystem. It’s a top-tier staking hub that makes Web3 ridiculously easy, thanks to seamless integration with its native wallet.

You can access on-chain staking products, earn flexible APRs, and manage your assets across chains without ever leaving the platform.

Everything’s subscription-based and transparent, and your rewards drop in either daily or when you redeem, depending on the protocol. It’s simple, fluid, and gives you real control over how you stake and earn.

Security-wise, OKX plays in the big leagues. You get proof-of-reserves, fund insurance, and battle-tested infrastructure behind every transaction. Plus, real-time APR updates and a no-fuss Web3 wallet bridge mean you can learn how staking works while actually earning from it.

With access to its own NFT marketplace, DeFi dashboard, and dual earn products, OKX stacks utility on top of performance—making it one of the best crypto staking platforms out there for users who want DeFi access without DeFi headaches.

| Feature | Details |

| Type | Hybrid (Centralized + DeFi integration) |

| Cryptocurrency Support | ETH, SOL, ADA, TRX, AVAX |

| Staking | ✅ (SOL 7.85%, TRX 4.68%, ETH 2.27%) |

| Other Noteworthy Perks | Multichain Web3 wallet, real-time APR tracking, on-chain DeFi access |

2. MEXC

MEXC isn’t just another CEX—it’s a staking powerhouse with eye-popping APYs and plenty of yield action across trending tokens.

Whether you’re just getting into DeFi staking or hunting for those juicy passive income plays, MEXC offers one of the smoothest, most accessible staking products out there.

If you’re after something longer or more stable, flexible savings are available on assets like $USDE, offering up to 10% interest with daily payouts and zero lock-up.

What sets MEXC apart is how flexible and automated it is: earnings kick in after T+1, interest is auto-distributed daily, and you can cash out from flexible savings anytime—no strings attached.

The platform is also stacked when it comes to asset diversity and liquidity. You’ve got access to 1,600+ tokens and all the hottest sectors, from GameFi to DeFi blue chips. MEXC keeps fees low, and it’s geared for fast-moving traders with deep liquidity pools and solid security to back it all.

With its high-yield fixed savings, flexible staking, and no-nonsense user flow, MEXC easily ranks among the best crypto staking platforms for both casual and serious DeFi earners.

| Feature | Details |

| Type | Centralized |

| Cryptocurrency Support | USDC, PI, BXN, USDE, RABI |

| Staking | ✅ (BXN 300%, USDC 100%, USDE up to 10%) |

| Other Noteworthy Perks | New user staking boosts, daily interest payouts, zero-lock flexible savings |

1. Margex

Margex puts serious yield power in your hands without all the staking headaches. Its DeFi staking setup delivers consistently high APYs—up to 7% across major coins—while keeping things smooth and flexible.

No lockups, no hidden terms. Just daily compounding rewards you can track in real-time while keeping your crypto free to trade.

Staking on Margex is as chill as it gets. You can earn 7% APY on Ethereum ($ETH), Tether ($USDT), and Binance USD ($BUSD), and even Bitcoin ($BTC) still clocks in at 6%.

Daily reward accrual adds to the appeal, especially for larger holders. Margex even gives you a live profit calculator, so you can see how your earnings stack with compound growth. For example, $50K in BUSD can earn you $3,500 in a year—automatically reinvested.

Where Margex really stands out from platforms like OKX and MEXC is in its no-lock, fixed-APY approach. While OKX leans into multichain flexibility and MEXC drops sky-high APYs on short-term promos, Margex keeps it simple and sustainable.

You get the stability of long-term passive income without managing lockup periods, unpredictable yield farming mechanics, or asset conversion requirements. That consistency makes it a go-to for anyone who wants to grow crypto passively with minimal friction.

| Feature | Details |

| Type | Centralized |

| Cryptocurrency Support | BTC, ETH, USDT, USDC, BUSD |

| Staking | ✅ (ETH 7%, BTC 6%, USDT 7%) |

| Other Noteworthy Perks | Daily compounding, no lockups, real-time reward tracking |

How We Selected the Best DeFi Staking Platform

Choosing the best DeFi staking platform isn’t just about chasing the highest APY. There are a few key metrics that separate the real earners from the risky plays.

Here’s what we looked at—and why it matters if you’re serious about growing your crypto passively:

- Reputation and trust – We focused on platforms with strong user bases, solid regulatory footprints, and transparent operations. BingX and Binance both back their services with proof-of-reserves and long-standing reputations for reliability.

- Wallet security features – Platforms need airtight protection, from asset insurance to AI-based threat detection. OKX and BloFin, for example, stand out with multi-layered security and real-time monitoring baked into their ecosystems.

- Blockchain support – Multichain access makes a platform way more useful. OKX offers seamless Web3 staking across chains like Ethereum, Solana, and Avalanche, while Binance lets users access DeFi through both its native chain and external protocols.

- Staking – We ranked platforms that offer high-yield, flexible, or auto-compounding options across top tokens. MEXC’s short-term staking promos and Margex’s no-lockup daily compounding model both cater to different types of earners.

- Compatible platforms – We gave points to exchanges with both web and mobile access, as well as unified wallets or account systems like Bybit’s and OKX’s—designed to simplify everything from staking to trading.

- dApp compatibility – Platforms like OKX shine here with built-in Web3 wallets and DeFi dashboards that let users interact directly with dApps without leaving the ecosystem.

- Ease of use – A clean interface goes a long way. BingX nails it for newcomers with its simple savings dashboard, while Binance blends beginner tools with pro-level options.

We’ve tested and evaluated each provider using these same standards—so you can trust our picks are based on what actually works.

Findings

When exploring staking opportunities, finding the best DeFi staking platform means weighing factors like APYs, asset flexibility, platform security, and ease of use.

Throughout this guide, we’ve looked at how different exchanges approach these features—from Margex’s simple, no-lock staking with daily compounding to MEXC’s high-yield fixed savings tailored for short-term gains. Each offers unique advantages depending on your goals and risk tolerance.

While these platforms provide potential for passive income, staking always carries some level of risk. It’s worth taking the time to compare terms, assess platform credibility, and make sure the setup aligns with your investment strategy.

FAQ

1. What is the best staking platform?

The best staking platform depends on your goals, but Margex and MEXC stand out for their user-friendly experience and flexible yield options. Margex offers consistent daily rewards with no lockups, while MEXC provides high-APY promos and broad token support for short-term and long-term staking strategies.

2. What does it mean to stake crypto?

To stake crypto means you’re locking up your digital assets to support network operations or liquidity in exchange for rewards. It’s a way to earn passive income on tokens you already hold without needing to actively trade.

3. Is DeFi staking safe?

DeFi staking can be safe, but it depends on the platform’s security and transparency. Trusted providers like Margex and OKX offer real-time reward tracking, multi-layer security, and clear terms to reduce unnecessary risk.

4. Is it possible to lose money by staking in DeFi?

Yes, it is possible to lose money by staking in DeFi if the platform is compromised or the asset value drops significantly. That’s why it’s important to use vetted platforms and understand the staking terms and market volatility involved.