Finding the best crypto tax software can feel like solving a Rubik’s cube blindfolded – especially if you’re juggling DeFi, NFTs, and multiple exchanges. The IRS isn’t messing around, and one mistake in your crypto tax reporting could cost you big.

But don’t stress – this guide breaks down the top tools to help you calculate crypto taxes automatically, track your transactions, and report crypto gains and losses without the spreadsheet nightmare.

We’ve looked at automation, integration with wallets and exchanges, crypto tax calculator features, support for international users, and pricing (including free crypto tax software options).

We’re diving into solutions like CoinTracking, CoinLedger, and Blockpit – each packed with features that’ll make your tax season smoother than a bull run.

Best Tax Software for Crypto – Overview

- ZenLedger – Offers extensive integration with over 400 exchanges and 20+ DeFi protocols, streamlining tax reporting for complex portfolios

- TokenTax – Provides real-time previews of your tax bill, helping you stay informed and plan accordingly

- Blockpit – Features tools like tax-loss harvesting to help minimize your tax burden effectively

- CoinLedger – Simplifies tax reporting with easy imports from numerous exchanges and wallets, making it accessible for users at all levels

- CoinTracking – Offers detailed portfolio analysis alongside robust tax reporting features, making it a top choice for overall management

What is Crypto Tax Software?

Crypto tax software is a tool that helps you automate the process of calculating, reporting, and filing your cryptocurrency taxes. It syncs with your crypto wallets, exchanges, and DeFi (decentralized finance) platforms to track transactions, apply tax rules, and generate compliant tax forms.

Without a crypto tax calculator, you’d be stuck combing through transaction history manually, which is not only time-consuming but also leaves you vulnerable to IRS (Internal Revenue Service) scrutiny if something slips through.

That said, it’s still worth weighing the pros and cons before diving into the best crypto tax software for your situation.

Best Crypto Tax Software Pros

- Automatic data import: Connects to hundreds of exchanges and wallets to auto-sync transactions.

- Accurate tax calculations: Uses tax-friendly accounting methods to calculate gains, losses, and income.

- DeFi & NFT support: Many platforms now support complex transactions from decentralized protocols.

- Time-saving: Handles what would otherwise take hours (or days) of manual entry.

- Audit-ready reports: Generates forms like IRS Form 8949 and international equivalents.

- Portfolio tracking: Some tools double as a dashboard for your holdings and performance.

- Professional support: Top-tier options offer CPA support or even full-service filing.

Best Crypto Tax Software Cons

- Costs can add up: Advanced features are often locked behind paid plans.

- Learning curve: Some platforms can be overwhelming for crypto newbies.

- Incomplete integrations: Not all platforms support every token or obscure chain.

- Limited free features: Free versions are often restricted to a certain number of transactions.

- Customer support varies: Not every provider offers strong or timely help when things go wrong.

Overall, a solid cryptocurrency tax software can take the stress out of tax season, especially if you’re deep in the crypto game. It turns a massive headache into a quick checklist – and that’s a serious win.

Reviewed & Analyzed – The Best Crypto Tax Software

Choosing the right crypto tax software is crucial for managing your crypto assets and simplifying tax filing. Here’s an analysis of our top providers, each offering unique features to cater to various needs.

5. ZenLedger

If you’re juggling DeFi trades, NFT flips, and staking rewards, ZenLedger might be your new best friend. It’s built to handle the chaos of Web3, offering broad integration across 400+ exchanges and 20+ blockchains, plus support for DeFi and NFTs. Whether you’re farming yields or holding a long-forgotten meme token, ZenLedger automatically imports your transaction history and keeps things tidy.

This is especially useful when you’re trying to figure out how to report long-term crypto investment gains and losses without pulling your hair out.

For users wondering how to calculate crypto taxes automatically, ZenLedger handles it all – FIFO, LIFO, HIFO, you name it. It’s also one of the few tools that supports international tax jurisdictions, making it a go-to for global users.

And if you’re looking for free crypto tax software options, ZenLedger offers a free tier for up to 25 transactions – perfect if you’re just dabbling.

All in all, ZenLedger is a great pick if you’re dealing with high-volume trades or deep in the DeFi trenches.

| ZenLedger Pros ➕ | ZenLedger Cons ➖ |

|---|---|

| Integrates with 400+ exchanges and 20+ blockchains | Limited features on the free plan |

| Supports DeFi applications and NFTs | Some users report persistent technical difficulties |

| Offers tax-loss harvesting tools | |

| Provides access to tax professionals for expert assistance |

4. TokenTax

TokenTax is the finance nerd’s dream when it comes to crypto taxes. Why? Its biggest flex is real-time tax liability tracking – you’ll see your tax bill evolve as you trade. So, instead of getting slapped with a surprise in April, you can stay ahead of the curve all year long.

Beyond basic reporting, TokenTax provides advanced features such as error reconciliation, ensuring that any missing or incorrect tax data is promptly identified and addressed.

It integrates with major exchanges like Coinbase, Binance, Kraken, and Gemini, plus it supports DeFi and NFT transactions. So, it’s built for more than just spot trading. The dashboard is clean, reports are accurate, and it supports both FIFO and HIFO for crypto tax reporting strategies.

Now, it’s not the cheapest tool out there – plans with tax filing support start at a few hundred bucks – but for serious investors and those who want peace of mind during an audit, it could be worth every cent.

TokenTax solves the ultimate pain point: keeping you tax-ready all year, not just in April.

| TokenTax Pros ➕ | TokenTax Cons ➖ |

|---|---|

| Direct integration with multiple exchanges | No free plan |

| Supports diverse transaction types | Not a full-fledged portfolio tracker |

| Advanced error reconciliation features | |

| Integration with TurboTax for easy filing |

3. Blockpit

Blockpit brings something unique to the table: powerful tax optimization tools baked right into the platform. That means you’re not just filing taxes – you’re actively minimizing what you owe. It offers tax-loss harvesting suggestions, portfolio overviews, and capital gains insights that can seriously shrink your final tax bill.

The platform supports more than 50 wallets and exchanges, including MetaMask, Kraken, and Coinbase; plus, it’s a champ at handling DeFi activity.

For those wondering how to calculate crypto taxes automatically, Blockpit lets you sync your wallet data, auto-tag transactions, and generate country-specific tax reports.

The interface is clean and fairly intuitive, even if you’re not super technical. You can connect and track your entire portfolio for free. You only have to buy a tax license if you want to download your crypto tax report. So, you can take it for a spin before going all in.

If your goal is not just filing, but optimizing your tax position, Blockpit deserves a spot on your shortlist.

| Blockpit Pros ➕ | Blockpit Cons ➖ |

|---|---|

| Automated tax calculations | Limited support for certain jurisdictions |

| Real-time portfolio tracking | Some features may not be suitable for complex tax situations |

| Tailored tax optimization advice | |

| Supports numerous exchanges and wallets |

2. CoinLedger

If you’re after ease of use, CoinLedger might be the most beginner-friendly pick on this list. The dashboard is simple, and everything from importing trades to generating tax forms is smooth – even if you’ve never touched a spreadsheet in your life.

It supports integrations with 500+ wallets, exchanges, and blockchains. That includes big names like Coinbase, Binance, MetaMask, and OpenSea. If you’re wondering how to report crypto gains and losses across CeFi, DeFi, and NFTs, this platform does it all in just a few clicks.

Another highlight is CoinLedger’s transparent pricing – no guessing games or hidden fees. It offers do-it-yourself options and professional services if you need a little extra help. There’s even a free preview that lets you import your data and check your report before you pay.

If you’ve ever felt overwhelmed by crypto tax tools, CoinLedger is the one for you. It’s sleek, fast, and doesn’t overcomplicate things, making it ideal for both casual investors and high-frequency traders.

| CoinLedger Pros ➕ | CoinLedger Cons ➖ |

|---|---|

| Easy-to-use interface | Limited payment options (no cryptocurrency payments) |

| Integrates with major tax platforms | Some users report issues with transaction recognition |

| Extensive integration with exchanges and wallets | |

| Supports DeFi and NFT transactions |

1. CoinTracking

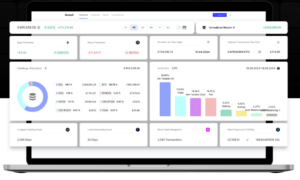

If you’re looking for the full package, CoinTracking is it. This platform doesn’t just handle tax forms, it gives you a complete view of your crypto life. It’s the go-to if you want both crypto tax reporting and portfolio tracking in one powerful dashboard.

Its tax reporting engine is incredibly detailed. You can generate over a dozen different report types, including Form 8949, Schedule D, and international tax formats. Plus, it gives you full control over tax methods – FIFO, LIFO, HIFO, you name it.

The cherry on top? CoinTracking has been around since 2013, making it one of the most trusted crypto tax tools on the market. That long track record, paired with rich functionality, makes it a top pick for serious crypto users.

If you’re serious about tracking crypto transactions and optimizing your tax situation, CoinTracking is the software to beat.

| CoinTracking Pros ➕ | CoinTracking Cons ➖ |

|---|---|

| Comprehensive portfolio tracking and tax calculation | Interface may be complex for beginners |

| Supports a wide range of cryptocurrencies | Some features require manual data entry |

| Detailed analytics and customizable reports | |

| Bulk import and custom integration options |

How We Selected the Best Crypto Tax Software

Picking the best crypto tax software isn’t just about flashy features – it’s about which platform can actually save you time, reduce errors, and keep your crypto taxes fully compliant. Here’s a quick breakdown of the key factors we considered while reviewing these tools:

- Trust and reputation: We prioritized platforms with long-standing credibility and positive user feedback. For instance, CoinTracking has been around since 2013, making it one of the most battle-tested names in the game.

- Security and compliance: Security is non-negotiable when handling financial data. We gave higher marks to providers that use bank-grade encryption, offer 2FA, and comply with both US and international tax laws – like Blockpit and ZenLedger.

- Integration with wallets and exchanges: A top-tier crypto tax calculator should support all your platforms. We favored tools like CoinLedger and CoinTracking that connect to hundreds of exchanges, wallets, and DeFi protocols to keep everything in sync.

- Ease of use: Your tax tool shouldn’t feel like rocket science. Providers like CoinLedger stood out with clean dashboards, simple workflows, and minimal manual input required.

- Advanced reporting capabilities: We looked for software that offers comprehensive reports like Form 8949, Schedule D, and real-time capital gains tracking – something TokenTax and CoinTracking both do well.

- Global accessibility: Whether you’re in the US, Europe, or anywhere else in the world, your software should work for your region. Blockpit shines here with pre-filled reports for multiple countries.

- Pricing and free tiers: Good value matters. We checked for free crypto tax software tiers and clear pricing – ZenLedger and CoinLedger both offer low-risk ways to get started.

We apply these same metrics to ensure our recommendations are reliable and you get accurate, hassle-free crypto tax reporting every time. We thoroughly evaluate each platform to guarantee that the options we provide meet the highest standards of trust, functionality, and user experience.

Is Using the Best Crypto Tax Software Worth It?

Absolutely – using the best crypto tax software is worth it if you want to save time, avoid costly errors, and comply with crypto tax laws. These tools automate your tax calculations, sync your wallets and exchanges, and help you accurately report crypto gains and losses, even across DeFi and NFT trades.

That said, it’s still important to consider your individual tax needs, portfolio size, and level of trading activity before jumping in.

Use Crypto Tax Software If:

- You trade across multiple exchanges

- You’re active in DeFi or NFTs

- You need audit-ready tax reports

- You want to calculate taxes automatically

- You need help tracking crypto transactions

Don’t Use Crypto Tax Software If:

- You only make a few simple trades

- You already file taxes manually

- You don’t use centralized exchanges

In the end, crypto tax software can seriously reduce your tax season stress, but it’s not one-size-fits-all. Make sure to do your own research and compare platforms based on your portfolio and tax situation before locking one in.

How to Set Up the Best Crypto Tax Software – Get Started with CoinTracking

Getting started with the best crypto tax software is easier than you’d think – and we’re here to walk you through it step-by-step. In this quick guide, you’ll learn how to set up and start using CoinTracking, our top pick for managing and automating crypto tax reports.

Why CoinTracking? It’s packed with features, but the biggest win is its ability to track your entire crypto portfolio in real time while generating tax reports that are accurate, audit-ready, and compliant worldwide.

Step 1: Create Your CoinTracking Account

Head to the CoinTracking homepage and click ‘Sign Up.’ You’ll be prompted to enter your email and create a password. Once you confirm your email, your account will be active.

CoinTracking offers a free plan to get you started, which is great if you’re just testing the waters or have under 200 transactions.

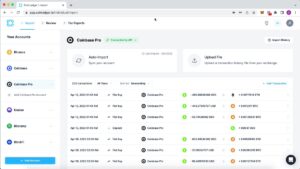

Step 2: Import Your Crypto Transactions

After logging in, go to the ‘Enter Coins’ section and select ‘Exchange Imports.’ CoinTracking supports automatic API imports and manual CSV uploads from 300+ exchanges like Binance, Coinbase, and Kraken.

For wallets, you can use xPub or direct wallet address tracking. Just follow the on-screen prompts to connect.

Step 3: Categorize and Tag Your Transactions

Once your trades are imported, go to the ‘Transactions’ page to review, categorize, and tag them. You can label income, gifts, forks, or airdrops manually or use bulk editing tools.

This step ensures that your tax reports are accurate and match your crypto tax reporting requirements.

Step 4: Generate Tax Reports Automatically

Navigate to the ‘Tax Report’ section in your dashboard. Choose your country, preferred tax method (FIFO, LIFO, HIFO), and fiscal year. CoinTracking will calculate everything for you – including gains, losses, and income – then generate downloadable reports like Form 8949 or Schedule D, ready to send to your accountant or upload to TurboTax.

Step 5: Monitor Your Portfolio Year-Round

Don’t stop at taxes – CoinTracking also doubles as a crypto tax calculator and portfolio tracker. Use the dashboard to check real-time portfolio performance, unrealized gains, and profit/loss stats across all your wallets and exchanges.

It’s perfect for planning tax moves before year-end.

Findings

Choosing the best crypto tax software can make a big difference in how efficiently and accurately you manage your crypto taxes. From real-time tax previews to robust integration with exchanges and wallets, the top providers each bring something useful to the table.

A solid tool helps you report crypto gains and losses without the manual headache – and that’s where platforms like CoinTracking really shine. With its in-depth portfolio tracking and flexible tax report generator, it stands out for users with complex trading activity.

Still, no software is one-size-fits-all, so take time to compare features and find the right fit for your specific needs.

FAQs

Which crypto tax software is the best in 2025?

The best crypto tax software in 2025 depends on your trading activity and reporting needs. For most users, CoinTracking stands out with its combination of real-time portfolio tracking, detailed tax reporting, and global compliance features. Other solid picks include CoinLedger for ease of use and ZenLedger for DeFi and NFT support.

What is the cheapest crypto tax software that has a free plan?

Several providers offer free tiers, but CoinLedger and ZenLedger have standout free crypto tax software plans for users with low-volume trading (typically under 25 transactions). These plans give you a chance to try out the platform before upgrading.

Which crypto tax software is best for DeFi and NFTs?

ZenLedger is one of the best options for users active in DeFi and NFTs. It supports a wide range of DeFi protocols, tokens, and NFT standards, making it easier to report complex transactions across multiple platforms.

How does crypto tax software calculate my gains and losses?

Crypto tax software uses your transaction data – buys, sells, transfers, and income – to determine cost basis and capital gains or losses. It applies tax methods like FIFO, LIFO, or HIFO and auto-generates reports that reflect your taxable events for the selected tax year.