The most straightforward answer to the question, what is a cryptocurrency, is the phrase virtual money. Each virtual currency is built on blockchain technology. Digital currency Bitcoin, like other cryptocurrencies, is used to pay bills or transactions. But at the same time, digital money does not have a central governing body. All operations are checked by the Blockchain network, i.e., by other users. Each block consists of chain operations. They are all interconnected. Therefore, it is impossible to fake or cancels a deal.

Cryptocurrency history

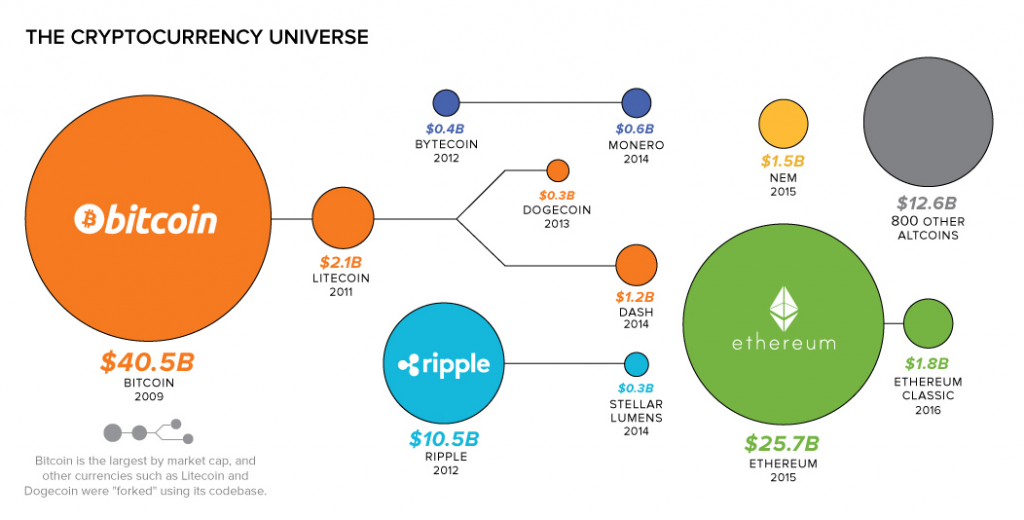

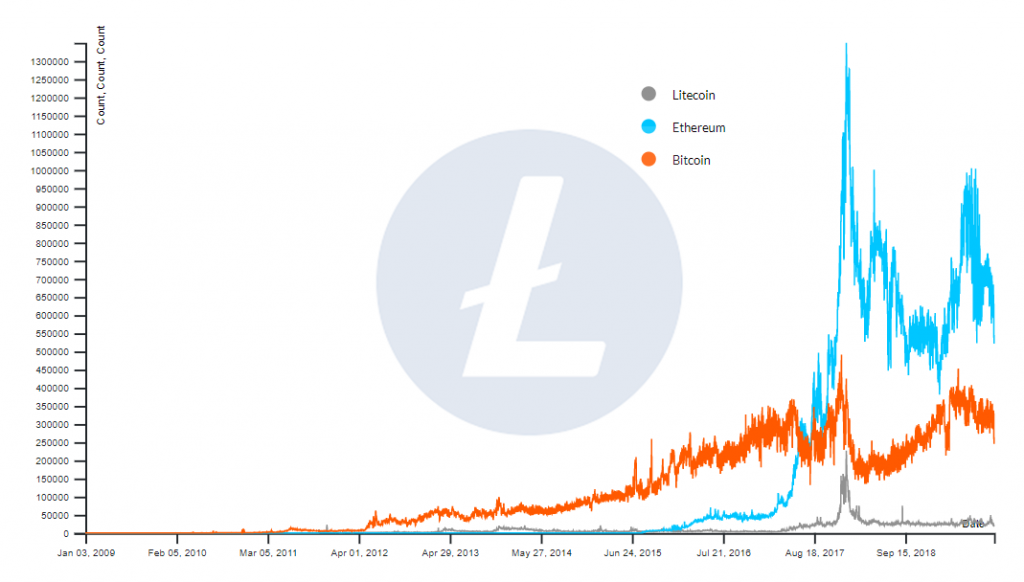

Bitcoin technology was first implemented on the blockchain example. Blockchain solutions have been tried before, but the attempts were not valued. Blockchain and cryptocurrency began to be widely used in the field of trade and investment, starting with the release of Bitcoins in 2009. Quickly create many other kinds of digital coins.

How does cryptocurrency work?

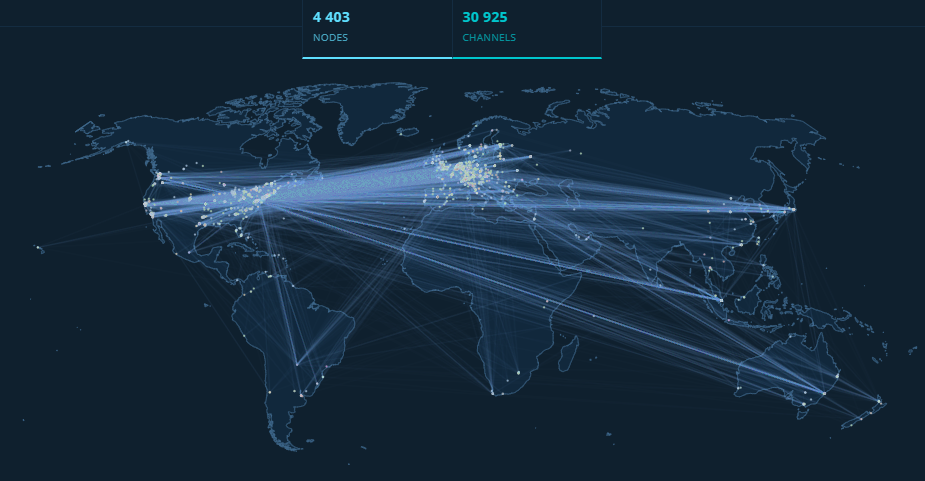

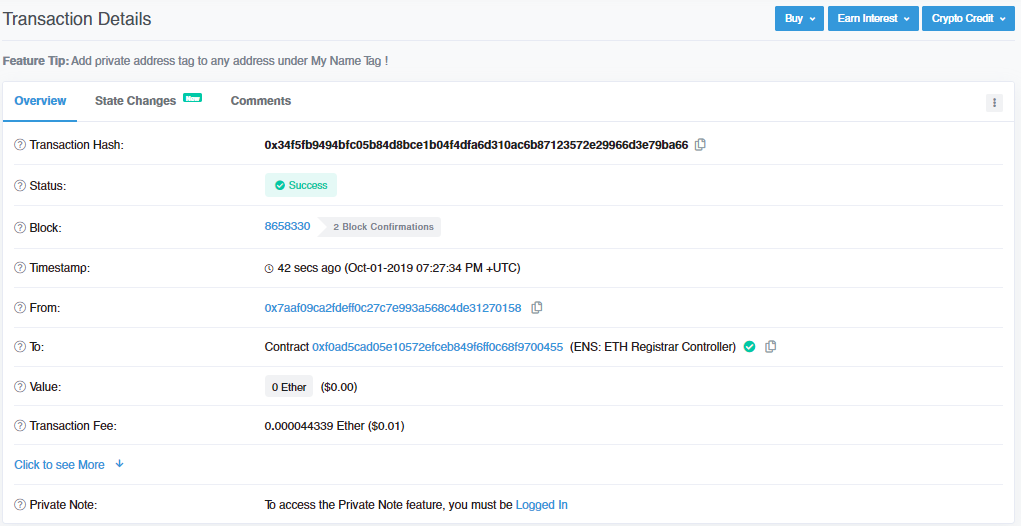

For a transaction to fall into the blockchain, it must be verified and confirmed by other network participants. The cryptocurrency system is built on the principle of decentralization. No bank or government organization can influence virtual currencies. Thus, the more participants use blockchain currency, the more secure transactions are.

What is a cryptocurrency?

Any new digital currency does not have a physical form but is only an entry in the blockchain system. Why is blockchain so reliable? Because cryptocurrency technology uses cryptography to produce new coins, confirm transactions, transfer coins, or any other transactions. Without specialized software, you won’t even get access to your coins.

Besides, all users of the network (all owners of specific cryptocurrency coins) will automatically learn about each transaction.

Fundamental principles for understanding cryptocurrency:

- Coins exist in a decentralized blockchain algorithm;

- All cryptocurrency system is transparent for all users;

- The blockchain is unchanged, which means that all transactions are consistent.

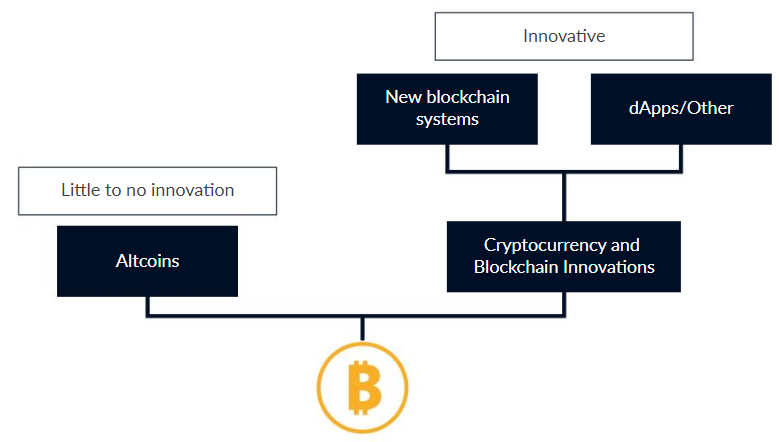

Altcoin

This word is an abbreviation of an alternative coin. Altcoins are commonly called all other cryptocurrencies that were created after Bitcoin.

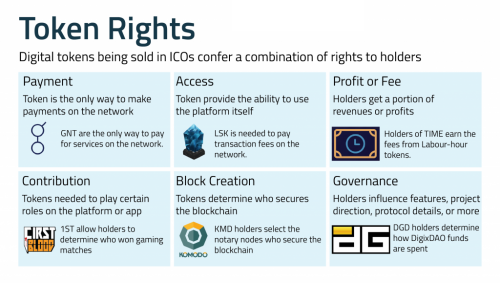

Crypto token

Blockchain project can be used not only for trade transactions. Open source allows you to use the blockchain system to create applications based on smart contracts. Since in this case, we are not talking about paying for services or trading using digital currencies, coins can be called tokens.

Blockchain and cryptocurrency

All blockchain currencies like Bitcoin use the power of digital ledger members to write information to the node blockchain. Until other users of the blockchain network confirm the transaction, it can be canceled.

The information must be confirmed by 1 to 6 users, depending on the amount of the transaction. For this, they receive a reward in the form of the new Bitcoins or another new cryptocurrency.

After confirmation by users, transaction information is stored in the electronic node. Therefore, only owners of Bitcoin or another currency can control mining and system development.

What is cryptocurrency mining?

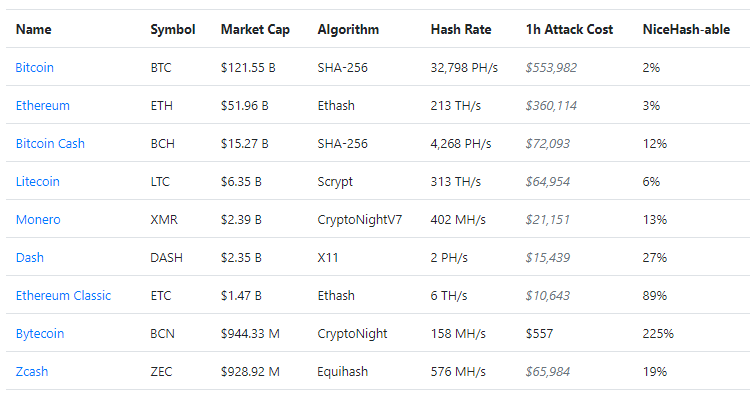

Since the government cannot control cryptocurrency, a developer using the pseudonym Satoshi proposed an SHA 256 hash algorithm for mining BTC. The process of creating coins and the simultaneous development of the network is to generate hexadecimal numbers. They must be less than or equal to the target hash to create a block in the chain of the same blocks. This process is called proof of work.

For mining, users will need specialized hardware or software. Given the price of equipment and electricity, mining is not always profitable. Is Bitcoin the only a cryptocurrency that develops according to such a scheme? All new cryptocurrencies that appeared later are based on the same research.

Revolutionary Properties

- Blockchain technologies minimized the risk of fake transactions. To hack into a system, you must have 51% of the power of the entire network. Since there are a lot of participants, and the equipment is costly, it is unlikely that someone will decide to launch a hacker attack. It is simply not profitable.

- The second distinct possibility is that cryptocurrency is decentralized. The state can in no way affect the value of coins, inflation, and other changes in the cryptocurrencies market (except for the complete ban on the use of currencies like Bitcoin in some countries).

- Thirdly, when answering the question of blockchain what it is, we understand that this is an invariable system. Based on this algorithm, you can create any database. It can be private property registers, patient card at the clinic or school journals with grades. Based on the blockchain, you can create an application that all participants will have access to.

Understanding cryptocurrency properties

Before you start working with different digital coins, learn some basic standards about them:

- When one user sends another cryptocurrency to the user, the transaction is verified and confirmed by a third user (miner) or several miners. After a deal has entered the network, the block is impossible to change. By this principle, going all cryptocurrencies.

- Even though the blockchain network shows all participants the addresses from which transactions occur, all personal data is classified. No one will know your name or what you spent crypto on.

- Transactions using all cryptocurrencies are instantly reflected in the network. Then you need to wait for confirmation only a few minutes. It makes no difference where you and your counterparty are on the globe.

- An essential property of the invented system defines security. Money is blocked on a specially generated cryptographic address. To get access to them, the owner must have a secret key (password). Hacking such a store is almost impossible.

- Everyone can buy Bitcoin other cryptos. Google introduced many individual exchanges and services of various types for this. People can store their funds on hardware digital wallets, software, in the form of a numeric code printed on paper or directly on the stock exchange (this option is not safe).

Not Your Private Keys, Not Your Bitcoin

main rule of cryptoworld

What is Cryptocurrency: Monetary properties

In the introduction to the article, we started to analyze the basis of the function of crypto coins. They can act as a means of payment, such as dollars. Moreover, from investments, the price dynamics are more similar to gold.

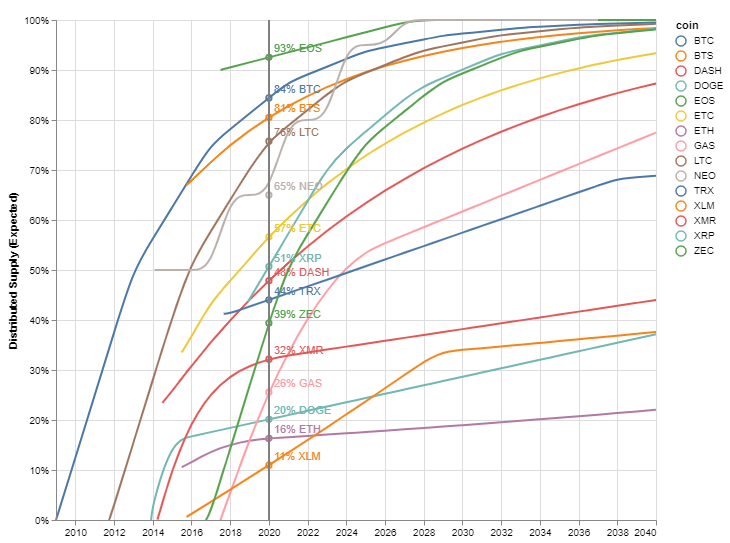

The algorithms of all electronic money prohibit arbitrary emission. Also, the number of coins is limited by the year, the number or number of issued tokens per year. It prevents inflation.

Also, electronic tokens, by definition, cannot be revoked or canceled by the government or central bank.

Understanding cryptocurrency: Dawn of a new economy

We all understand the increasingly valuable digital coins. They become famous thanks to cheap, fast, and anonymous transactions. Along with this, cryptocurrencies gives ample opportunities to trade on black markets. And public services cannot prevent this in any way, except for a complete ban (which is challenging to implement).

With the rise of cryptocurrencies, exchanges have also flourished. They are creating a daily turnover of more than millions of dollars. Companies that own these exchanges earn higher returns than owners of fiat stock exchanges.

Players at the auction can also win. But success or failure is hard to predict. Worth tokens are changed daily by 10, 100, or 1000%.

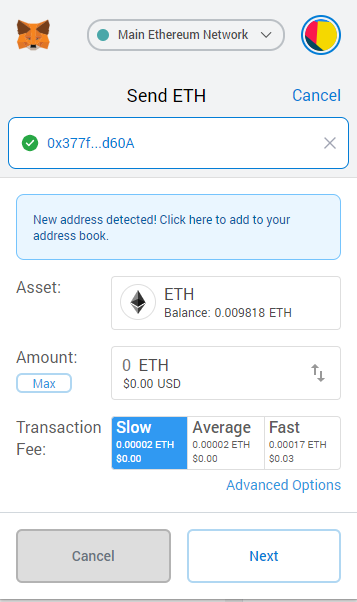

Transaction fees

Payments do not depend on the amount of the transaction but rely on the time of processing (confirmation) of the payment by the miners. Most systems offer the transaction participant to select the desired commission.

Exchanges often offer their customers a calculation of the processing speed of payment, depending on the size of the commission.

Exchanges

These are specialized sites that help customers exchange cryptocurrencies for friends (for example, Ether on Ripple). Some services make it possible to trade fiat currencies in exchange for crypto.

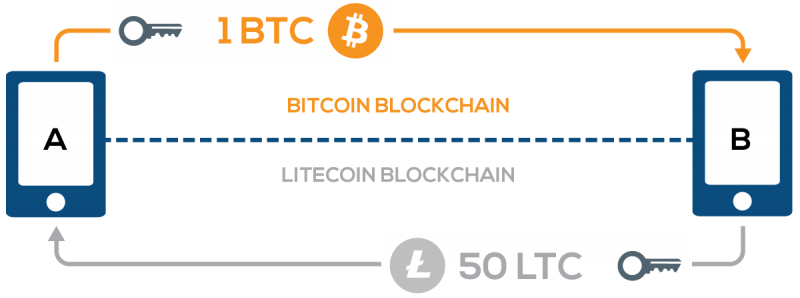

Atomic swaps

These are transactions between two owners of different cryptocurrencies bypassing intermediaries.

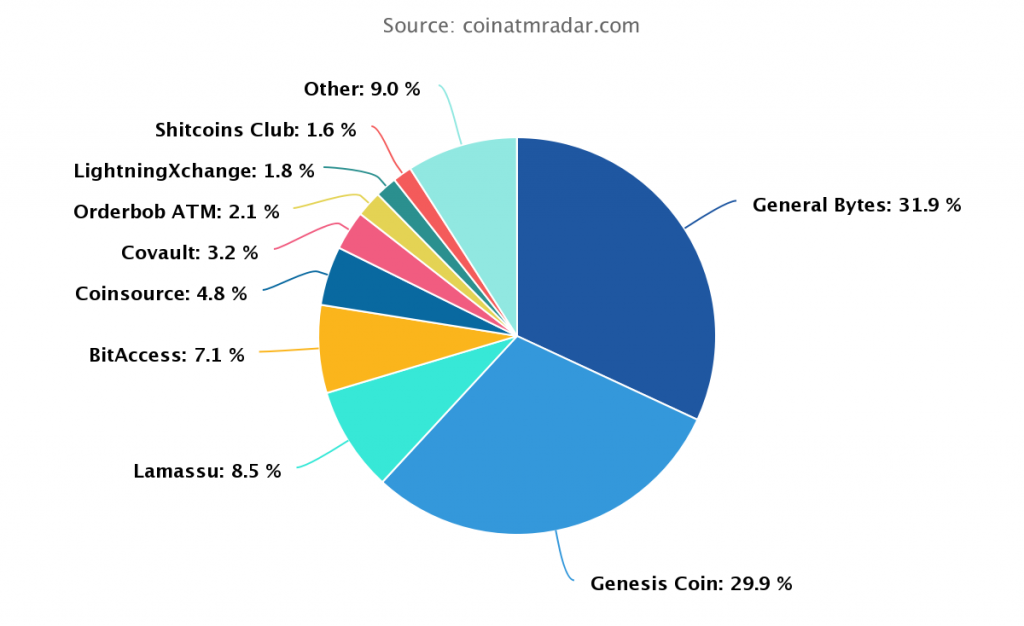

ATMs

These are specialized ATMs where you can buy a cryptocurrency for cash or, on the contrary, withdraw cash from a digital wallet.

Initial coin offerings

Initially, new coins have a limited first issue. Such a project is an investment in the hope that it will pay off in the future. Electronic tokens are also used by companies to replace stocks and avoid government regulation in the initial stages of work.

12 Cryptocurrencies Other Than Bitcoin

1. Litecoin (LTC)

The project started in 2011. Litecoin has open-source code and faster transaction confirmation than Bitcoin. You can verify transactions using conventional computer processors without buying special equipment.

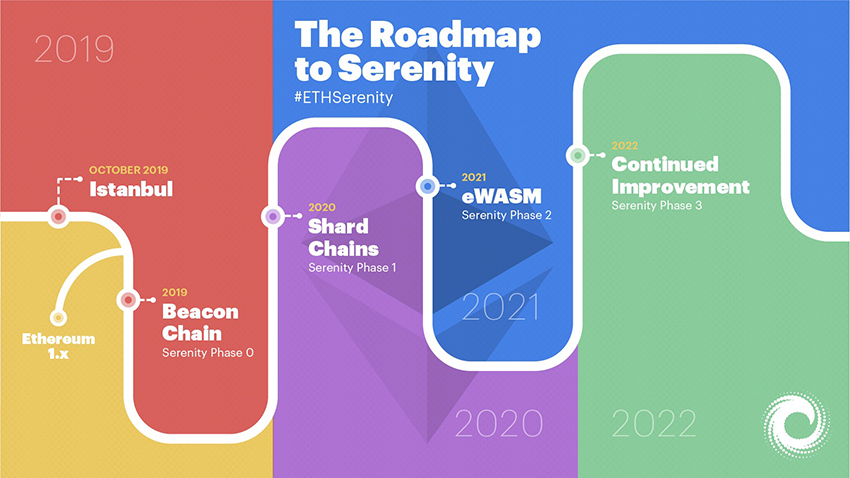

2. Ethereum (ETH)

In 2015, the open-source Ethereum software platform was launched. Developers can implement their projects on it using blockchain technology. The internal currency is called Ether. Now investors use it not only for promotion on the platform but also for trading on other cryptocurrencies. In 2016, a hard fork occurred, as a result of which two currencies appeared:

- Ethereum (ETH);

- Ethereum Classic (ETC).

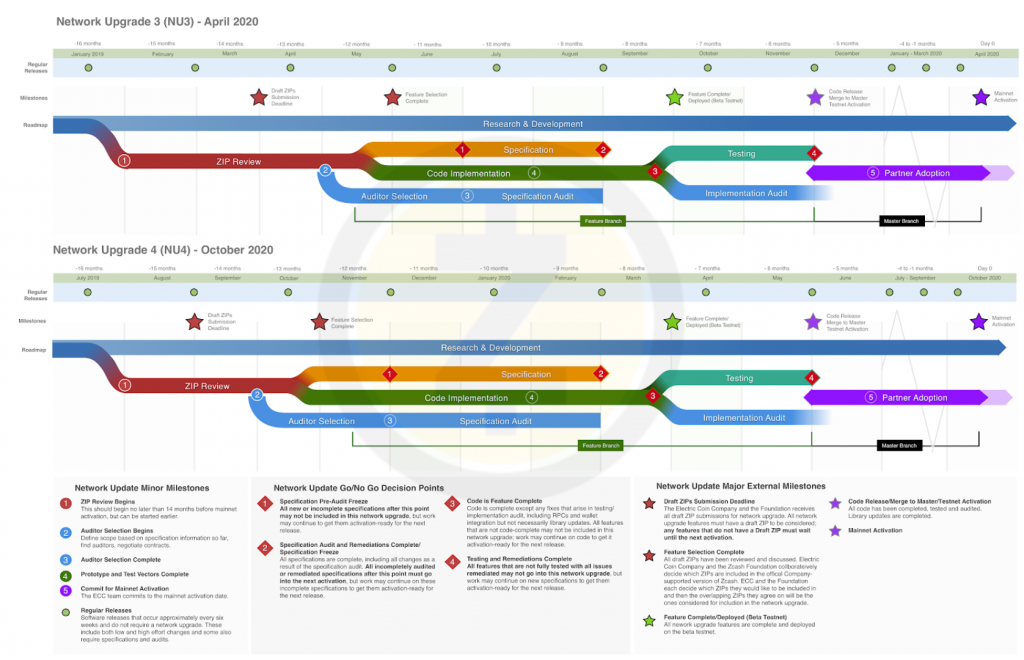

3. Zcash (ZEC)

ZEC coins were first launched on the market in 2016. Their developers are positioning the project as more secure than BTC. By analogy, all transactions are recorded on the blockchain (the system has an open code). But users do not see the address and transaction amount. There are two ways to encrypt a transaction:

- Using cryptographic technology;

- Using brand development zk-SNARK.

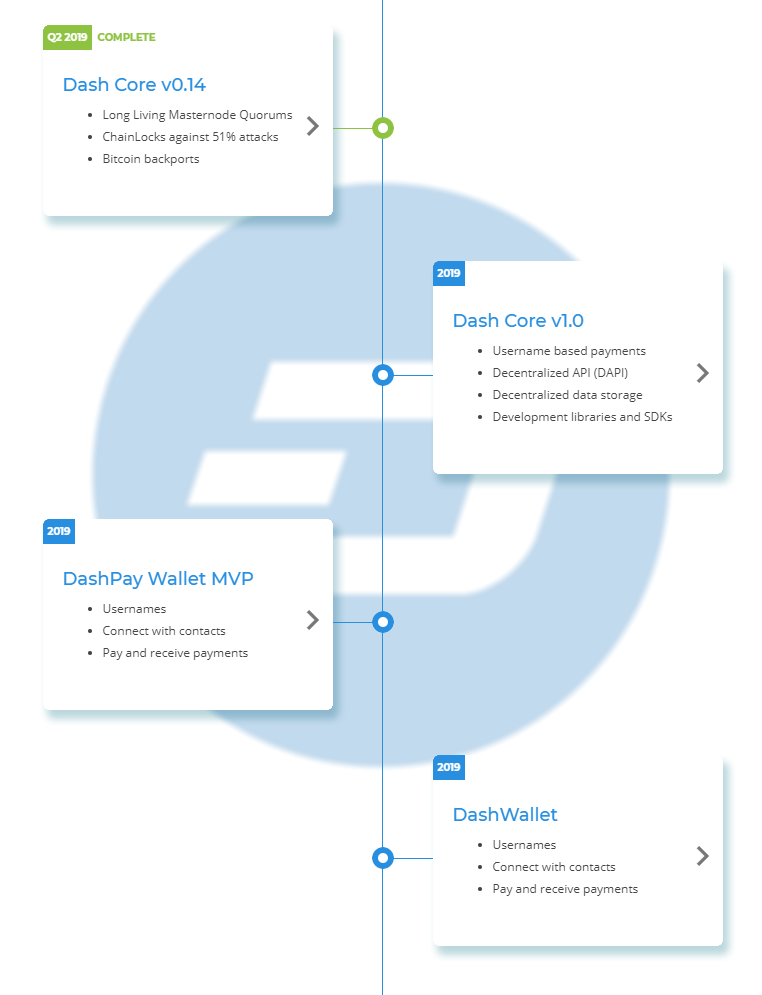

4. Dash (DASH)

The project started in 2014 (the original name was Darkcoin) and quickly gained popularity due to complete anonymity. The network is entirely decentralized. At the same time, you can mine coins using the CPU and GPU.

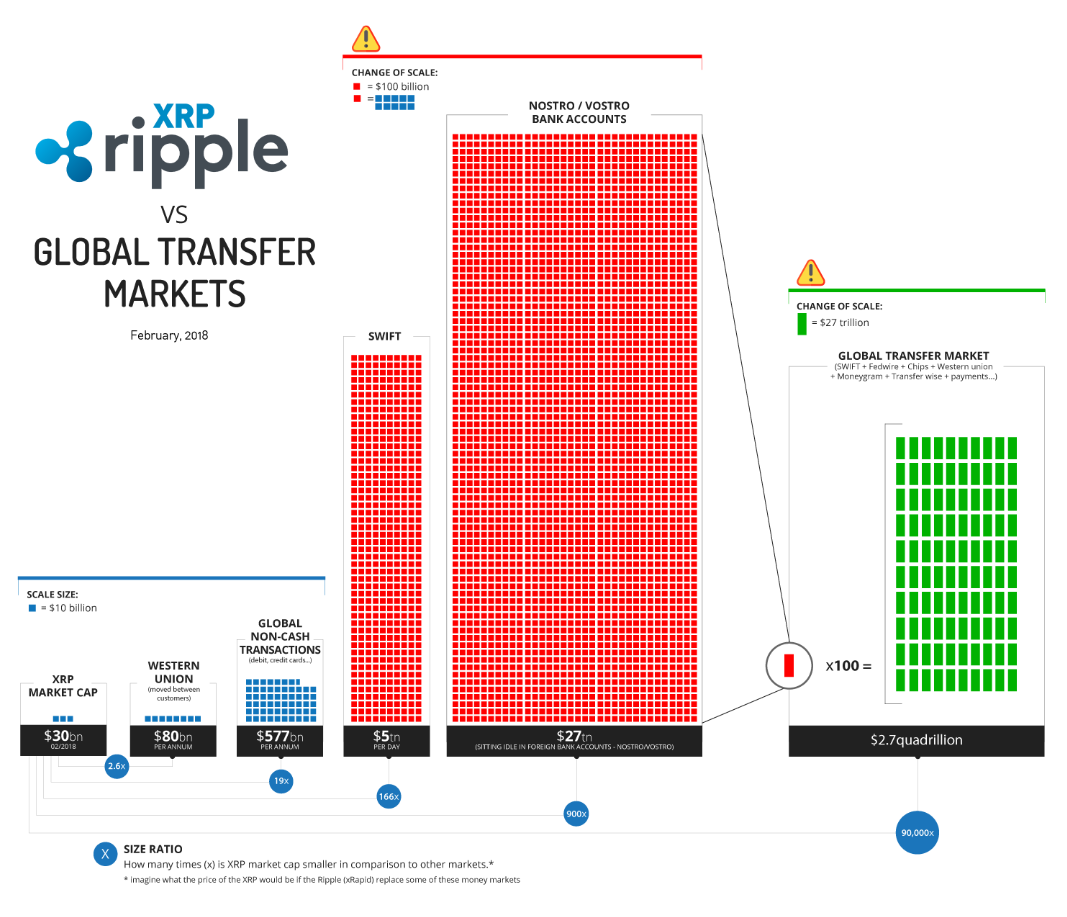

5. Ripple (XRP)

The token was first published in 2012. The main goal of the system is instant real-time international payments without reference to time zones and banks. Verification of transactions is carried out without standard mining. It reduces the load on the network, speeds up operations, and reduces energy costs.

Coins are distributed with a narrow focus. Most XRP investors either work in system development projects or are representatives of banks.

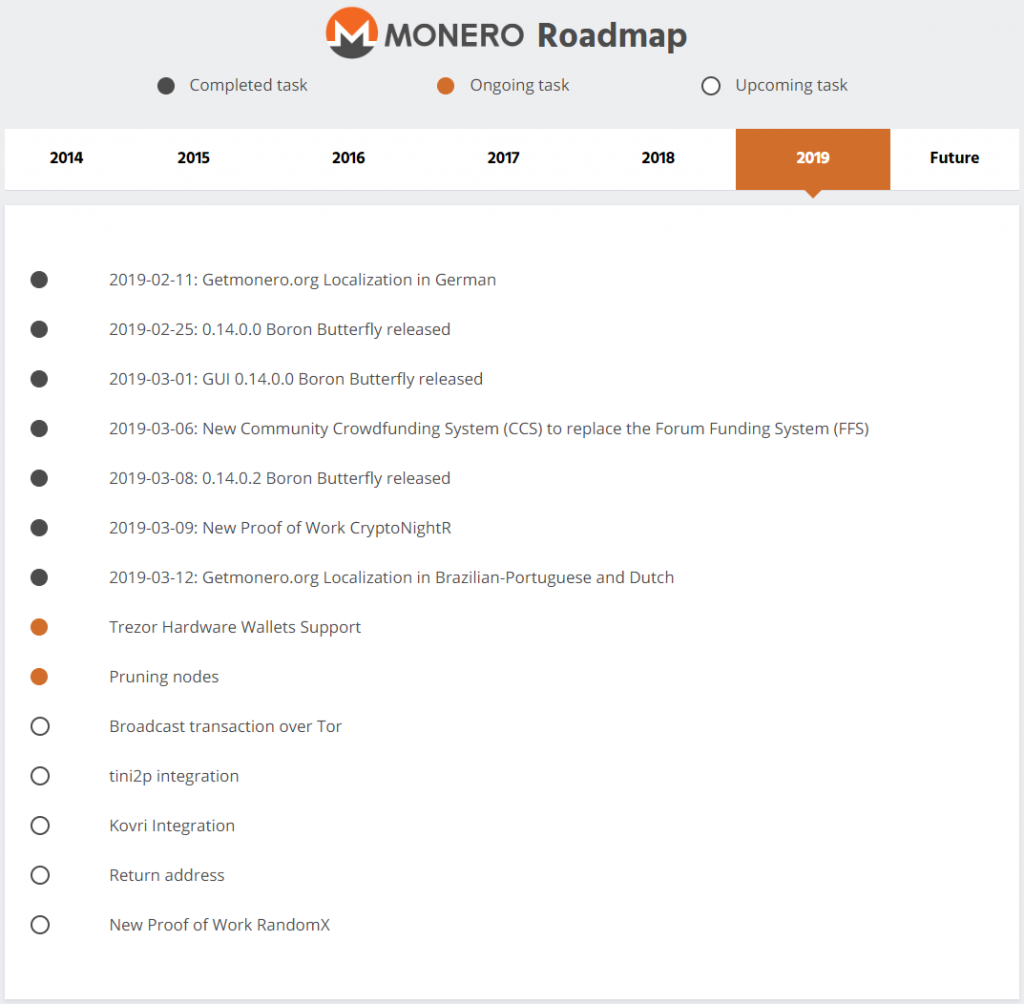

6. Monero (XMR)

The currency appeared in 2014 and has a new level of privacy. Thanks to the open-source code, the project is continuously being developed by enthusiasts. Transactions are verified using a ring signature algorithm. Among them, there is at least one signature of a real person, but they all look identical. Therefore, it is impossible to track the transaction or the verifier.

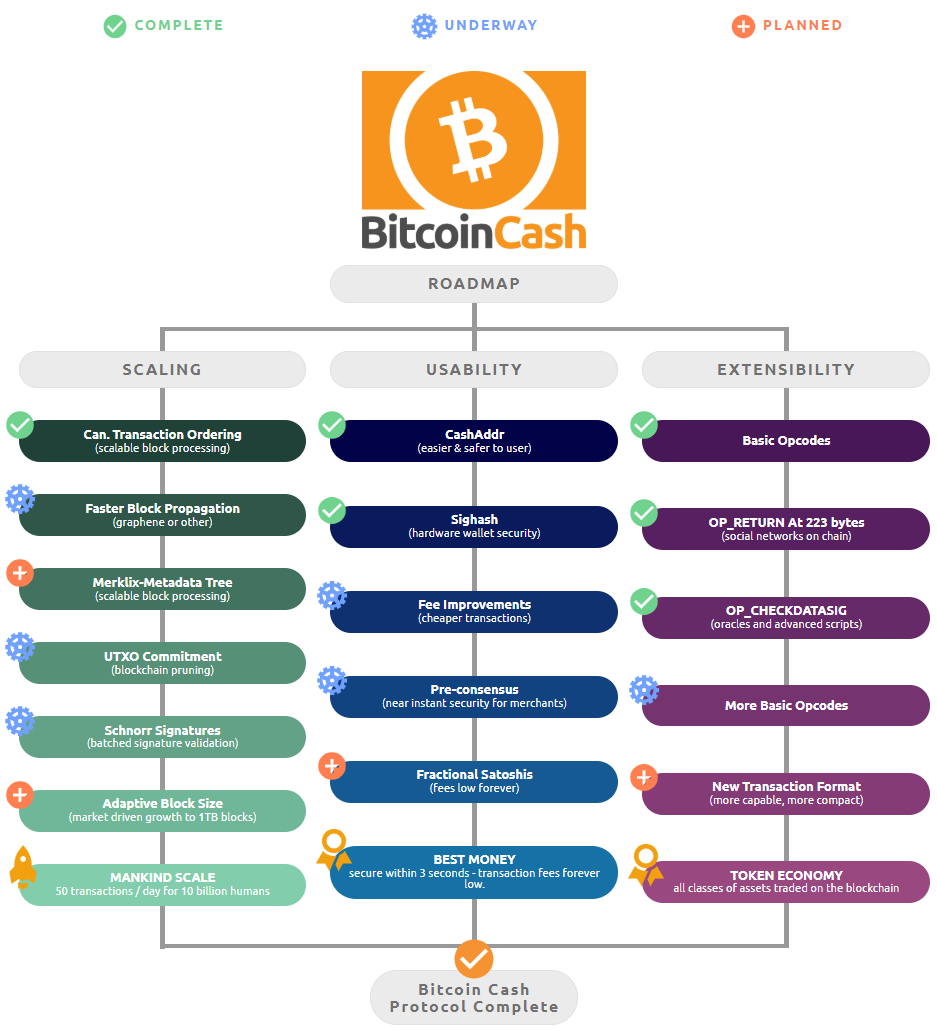

7. Bitcoin Cash (BCH)

This token appeared as a result of a hard fork between Bitcoin developers and a large group of miners. Enthusiasts make changes to the code, which transforms into a new kind of coin. BCH appeared in 2017 due to problems with system scalability. The original coin protocol strictly regulates the size of the blocks. Miners wanted to reduce transaction time by increasing block sizes. The Segregated Witness protocol has also been abolished.

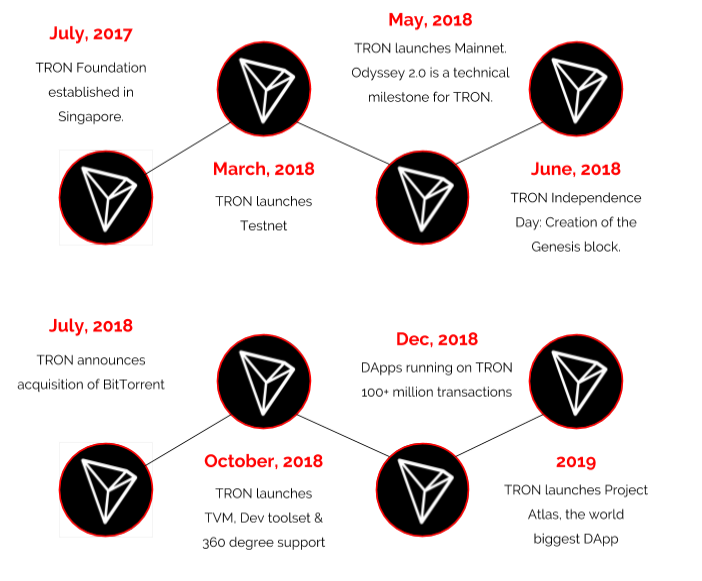

8. TRON (TRX)

There is a Chinese token that was created for settlements in the internal system. The platform works on the blockchain, and each developer receives a reward for the distribution of projects. The parent company is located in Singapore and has already involved Alibaba.com, Baofeng, and oBike.

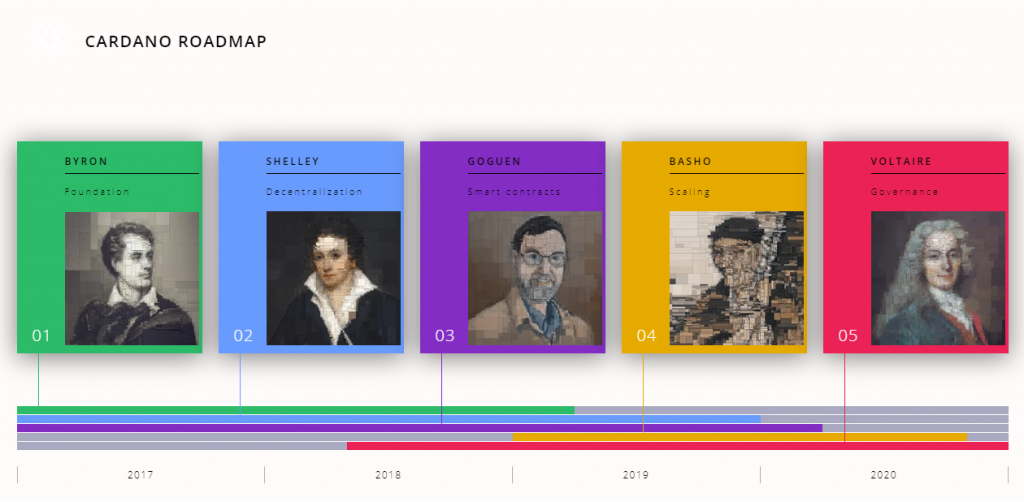

9. Cardano (ADA)

The currency launched in 2017 and combined the advantages of Ethereum (smart contracts) with the high speed and scalability of the system. One of the main goals is international payments with a processing speed of several seconds.

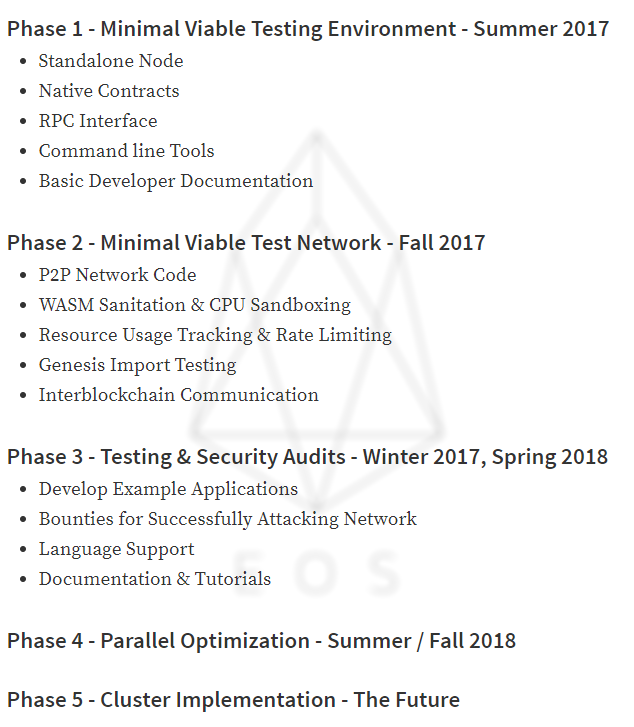

10. EOS (EOS)

The project was launched in 2018. The platform is also open source and offers all developers the opportunity to implement decentralized applications. The system consists of a blockchain platform and tokens. Several functional differences are that:

- No token mining;

- The transaction confirmation mechanism consists of generating blocks according to a particular scheme;

- The amount of remuneration depends on the performance of the unit;

- The system has unlimited scalability.

11. Binance Coin (BNB)

The token is implemented as a project on the Ethereum platform and on Binance’s own blockchain too but serves as the internal currency of the Binance exchange. This coin allows exchange investors to trade on more favorable terms and gain access to professional options.

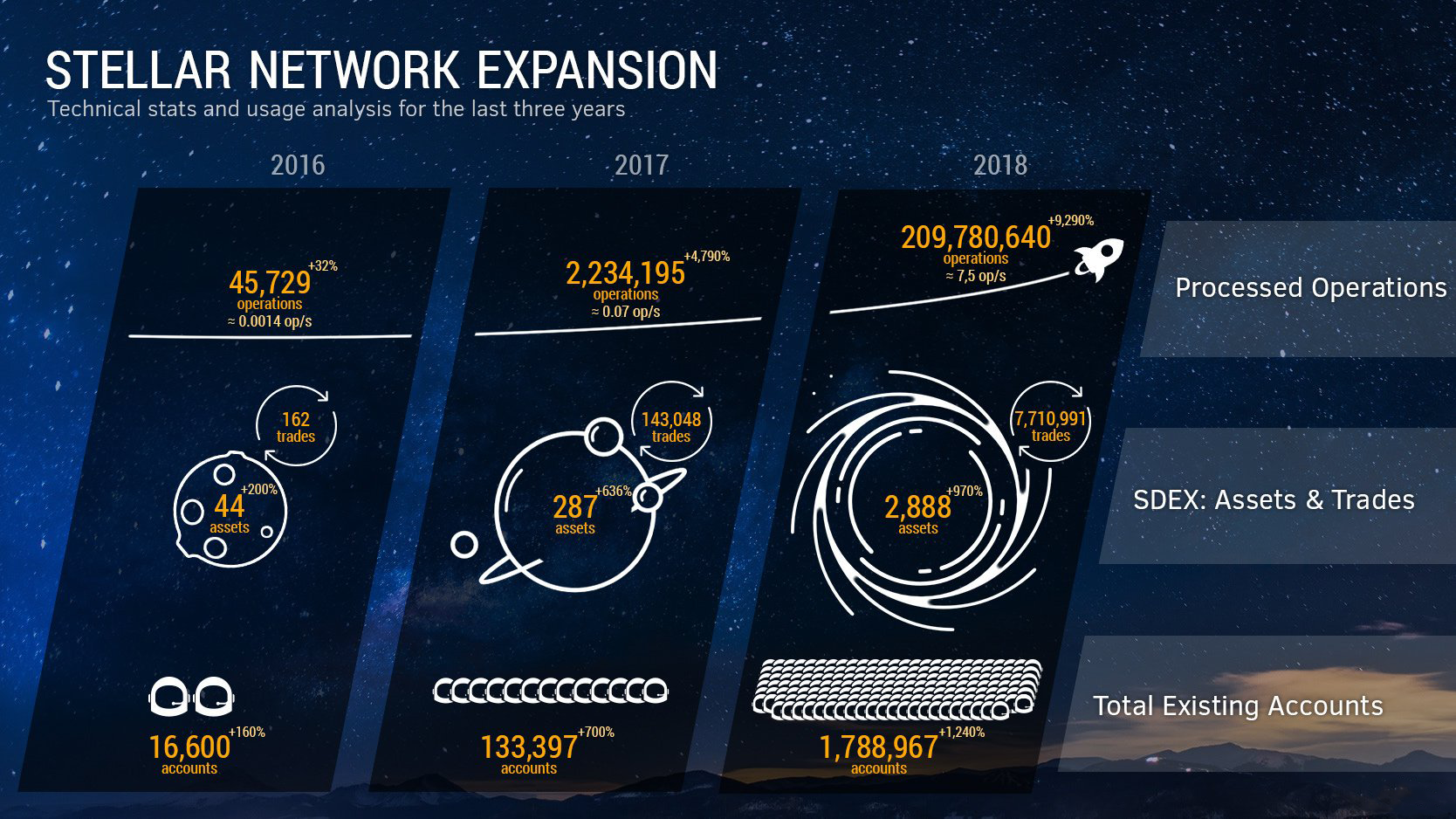

12. Stellar (XLM)

The token is focused on financial institutions and banks, on safe and fast payments. The project was created in 2014 as an improved version of Ripple with stronger decentralization. In 2015, the platform switched to a separate protocol, and the coins became known as Lumens. The code is still open.

Legality

Not all countries agree on the appropriateness of using cryptocurrencies. Some governments have entirely banned digital tokens. The list of countries is here https://en.wikipedia.org/wiki/Cryptocurrency#Legality.

Most countries explicitly or implicitly try to control digital transactions. For example, in the United States, the government requires Bitcoin owners to pay taxes as if they owned any other property.

Also, some countries see cryptocurrencies as an opportunity to avoid economic sanctions. To control digital transactions as much as possible, the Chinese central bank has begun developing its cryptocurrency.

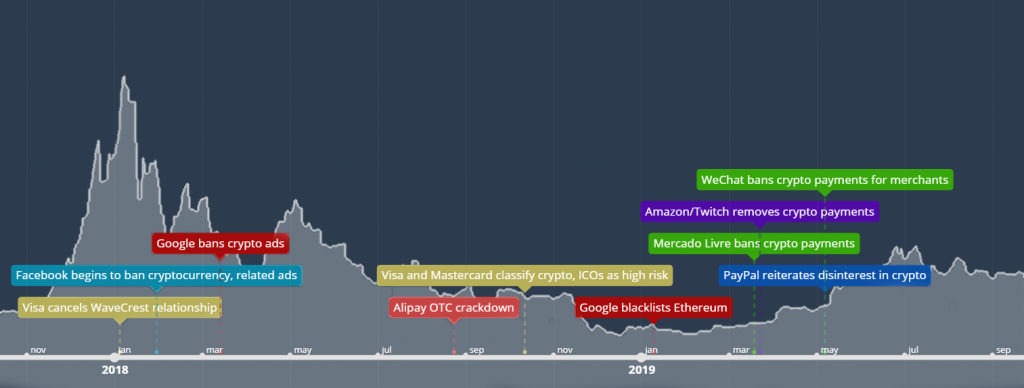

Advertising bans

Popular social networks and search engines such as Facebook or Google do not advertise any cryptocurrencies. Their example was followed by Japanese, Chinese, and Russian platforms.

U.S. tax status

In 2019, cryptocurrency owners in the United States received a newsletter requesting payment of a tax on coin ownership. Only capital gains are payable if the currency has increased in value.

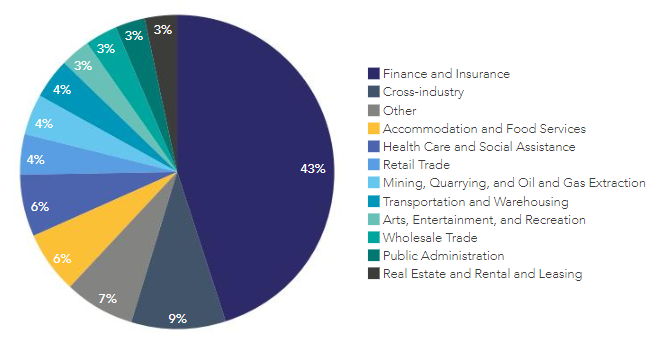

The legal concern of an unregulated global economy

Cryptocurrency systems are criticized for the inability to control money laundering and illegal transactions because of the failure to track purchases and asset owners. Also, owners of crypto funds easily evade taxes on the increased value of assets. Income received in altcoins is also impossible to track.

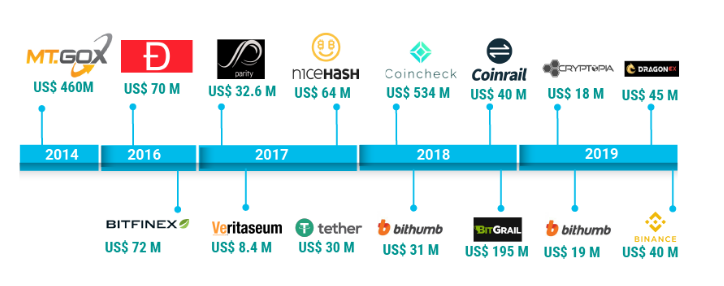

Loss, theft, and fraud

Cryptocurrency exchange fraud is one of the negative aspects of the emergence of crypto coins. Currency owners must either trust their assets to a stranger to complete a transaction. Or they should trust their money to a third party and rely on its decency. At any time, the service may be hacked, or the administration may block funds without explanation.

Some companies that imitate crypto try to deal with hacks. In 2017, hackers stole Tether tokens for USD 31 million. The administration has begun to create a new core for its Main wallet so that stolen coins become invalid.

In 2018, three cryptocurrencies were compromised by a 51% attack when confirming transactions. Theoretically, this can happen even with the most extensive network. The only question is the profitability of such an event.

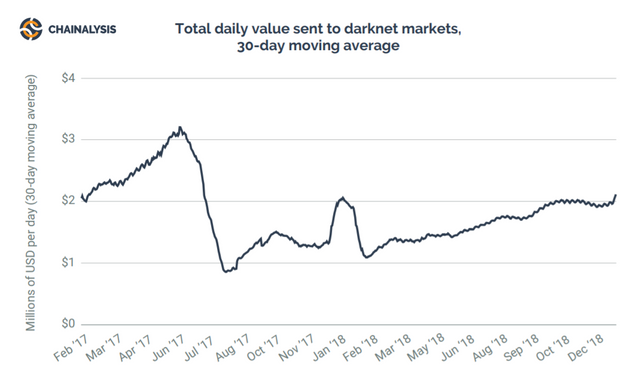

Darknet markets

The initial idea when creating digital tokens was freedom from banking systems, financial crises, the ruin of financial institutions, and inflation. But the inability to control transactions by the state led to the spread of digital currencies as a means of payment for prohibited goods.

What is Cryptocurrency: Conclusion

Different crypto platforms pursue various goals in development. Tokens perform the function of virtual money to pay for goods and services. The largest networks entered the financial market, along with fiat money. You can buy Bitcoins at a specialized ATM, and you can also cash fiat currency there (withdraw it from your digital wallet). Also, transactions using popular coins can be paid by standard bank transfer, credit, or debit card.

Traders quickly mastered a new opportunity to trade on exchanges. Many strategies have emerged similar to regular stock markets. Some services even offer high leverage trading.

Another function of tokens is the calculation in internal systems. It allows you to implement decentralized applications on the open-source cryptocurrency platform.

Whether or not to buy cryptocurrency is a moot point. All coins are highly volatile. Per day, the cost can rise or fall by 1000% or more! Therefore, currencies can be perceived as an investment, but successful or not, time will tell.

Good Written Article! Thanks for sharing

Nice Post !