Starting in 2019, Coinbase users can exchange cryptocurrencies for fiat (cash) or another crypto in more than 100 various regions. You may obtain Bitcoins, Ether, Bitcoin Cash, Litecoin by bank transfer, debit card or by linking your bank account. The big plus is that Coinbase fees are the smallest among other cryptocurrency exchanges.

How Does Coinbase Work?

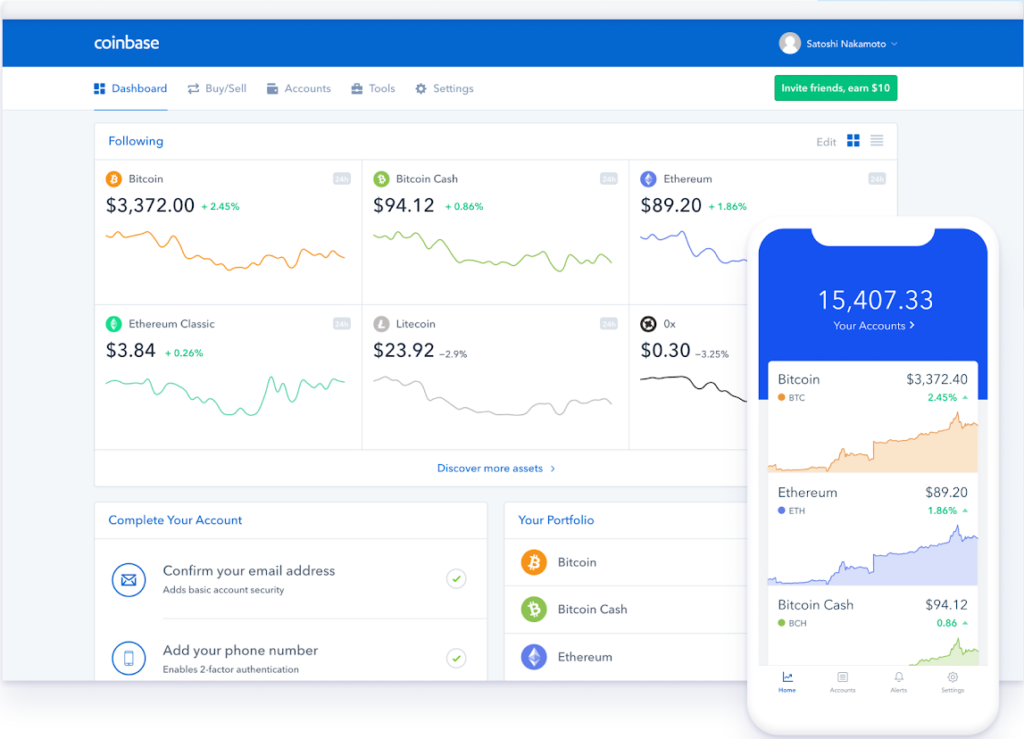

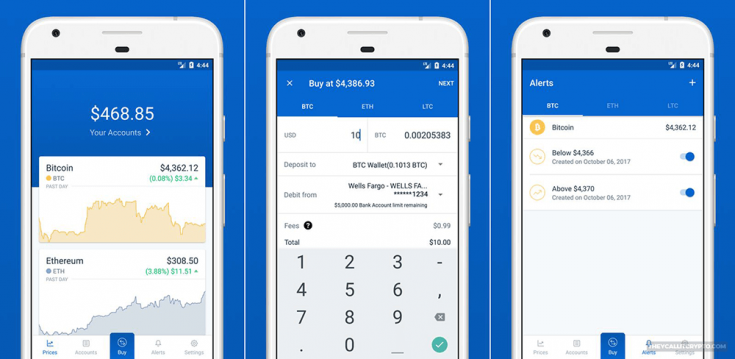

A distinctive feature of Coinbase trading is its super simple interface. For the reason, service is recommended for novice investors. The article will tell readers about the best ways to send and take coins. The easiest way to make a deal is by using a debit or credit card.

Coinbase fee on buying BTC or ETH compared to other services:

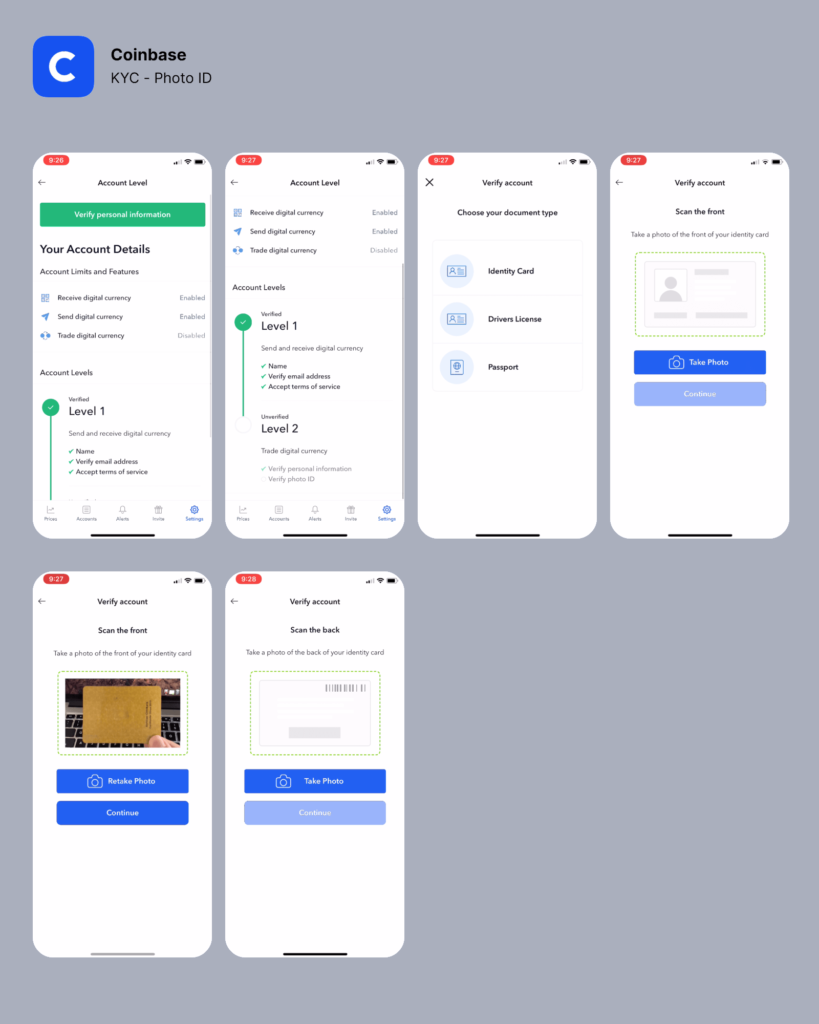

The prices are vary slightly depending on the number of orders, countries and banks. Using Coinbase, you should be prepared for a complete identity check. To register a Coinbase account, you need to provide a photo of your passport or driver’s license with an id number. Reconciliation of this data is only required if payment is made with money from a credit card. If a person has connected own bank account to Coinbase, the profile automatically becomes trusted.

What Payment Methods Can You Use on Coinbase? What About Coinbase Fees?

Coinbase exchange allows its users to upload funds in several ways. They differ depending on the country in which you live.

Reviews of well-known payment methods:

| Method of payment | Countries | Speed of execution order | Currency | Tariffs (indicators are approximate, specify the amount on Coinbase exchange) |

| Bank transfer | US | 5-7 days | USD | 1.49% |

| Visa or Mastercard | US | Immediate | Euro | 3.99% |

| Visa or Mastercard | Canada | Immediate | CAD | 3.99% |

| SEPA bank Transfer | Europe | 1-3 days | Euro | 1.49% |

| Visa or Mastercard | Europe | Immediate | Euro | 3.99% |

| Visa or Mastercard | UK | Immediate | GBP | 3.99% |

| Xfers bank Transfer | Singapore | Immediate | SGD | 1.49% |

| Visa or Mastercard | Australia | Immediate | AUD | 3.99% |

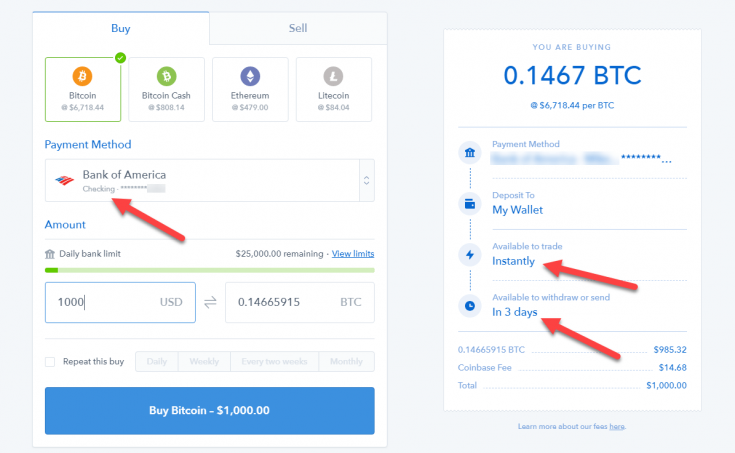

To wire or to withdrawal Coinbase coins you need to exchange the local currency for dollars or euros first. You can replenish stock new investment for free. But for all subsequent transactions, Coinbase users pay a percentage. Some people consider the lack of selling via PayPal to be a minus.

Supported Countries

In 2019, the list of countries has expanded significantly. Here are the most significant of them:

- The USA

- UK

- Canada

- Singapore

- All countries of Europe

- Mexico

- Chile

Limits & liquidity

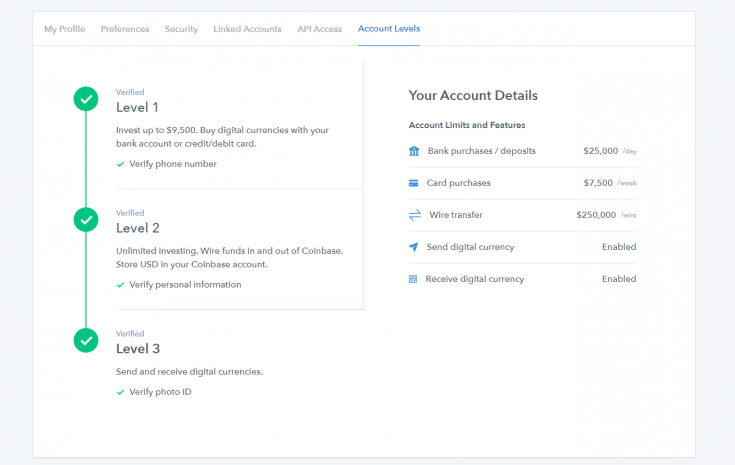

To carry Coinbase transactions secure, the organizers imposed limits on trade. The more personal data a client provides during registration, the larger amounts it can withdraw via Coinbase transfer.

If your identity is thoroughly verified, you may invest 50 thousand dollars, while in the USA, 30 thousand euros from Europe. The business may request a larger limit.

How Fast Does Coinbase Send You Bitcoins?

The speed with which Coinbase processes transactions depends on countries, network speed and charge method of payment.

United States

Any plastic card takes effect after verification of identity. Money transfer and buy through Coinbase is immediate. Bank transfer does not require the “Know your customer” policy. But Coinbase processes a bank transfer for at least five days.

Canada

Sell Bitcoin through Coinbase in Canada is possible in 4 days through the EFT system. There is also an Interac online service through which transactions are carried out instantly.

Europe

SEPA bank transfer for all European countries is confirmed in 1-3 days.

Coinbase wallet

Coinbase has created its Bitcoin wallet, which does not act like classic digital wallets. It is created on blockchain technology and has a password. But the organizers have access not only to the public address but also to private keys. Therefore, storing coins is like a regular bank account.

Coinbase has developed mobile apps for iOS and Android. To provide security for storing coins, you should choose the Multisignature Coinbase Vault. In total, the broker supplies three kinds of wallets:

- Hot option – appropriate for storing small amounts of money, sell or buy coins

- Cold storage – it is not available to hacker attacks but is controlled by the exchange administration

- Multisignature Vault – one private key is located at the exchange, the other two are known only to coin owners. At least two keys are required to complete a transaction

A big minus of the exchange, users, consider the possibility of blocking the account at any time. The exchange also keeps track of where you spend your coins. Therefore, we recommend in our guide not to leave a large sum in the service.

Coinbase developed a USD wallet for storing fiat money. With this wallet, you can buy cryptocurrencies without bank transfers. This way, you don’t need to expect several days for the transfer to be processed and verified.

Crypto to crypto trading

Before you can trade, your account must pass verification. The action scheme is as simple as possible:

- Click on the Buy / Sell tab in the upper right

- In the Coinbase currencies list, select the one you wish

- Indicate the sum in USD and the paying way

- Confirm the transaction using the private code

These were the stages of the purchase. The sale is not carried out by credit card. A merchant must use his bank account or deposit on Coinbase to entire the deal. The rest of the process is similar:

- Open the “Deposit / Sending currency” tab

- Log in to Accounts

- Choose the desired cryptocurrency

- Click Get

A warning!

The service will form an address where a trader may send his crypto. Always send one type of coin to each address. If you send two types of currencies to one address, one of them will be gone.

Coinbase Pro

Coinbase Pro until 2018 was named GDAX. The same people who own Coinbase runs the exchange. Coinbase Pro is destined specifically for progressive clients and has a sophisticated interface. But its undeniable advantage is the deficient fees.

For example, credit card transactions do not charge interest at all, and a trader pays 0-0.25% for a bank transfer, depending on the sum of the transaction.

Coinbase Pro does not charge a withdrawal fee.

An affiliate is not available in Canada, Singapore, Australia. There is no particular mobile application, but there is a good mobile release of the site.

Is Coinbase safe to use?

The location of Coinbase company is in San Francisco (USA). Reliable investors assist the brand, and FDIC insures deposits in the sum up to 250,000 US dollars. Crypto broker has licenses in the countries in which it functions.

KYC registration identity verification protects exchange customers from scam. To remove the limits, traders should to reaffirm their phone numbers and enable 2-factor verification.

For each deal request, the service generates the next address. Thus, other participants cannot track the location of your coins and their quantity, as well as where you spend them.

Findings

For beginners in trading, Coinbase is one of the most accessible options. Using the platform is no more difficult than shopping in an online store.